Conversion rate may sound a bit dull. But before you roll your eyes at another marketing metric, it’s worth noting that even a slight increase in your conversion rate – the percentage of new enquiries that go on to become paying clients – saves you time and grows your revenue.

Our data indicates that many advisers could double their prospect conversion rate by adopting a few simple changes. Read on to find out how.

First impressions count

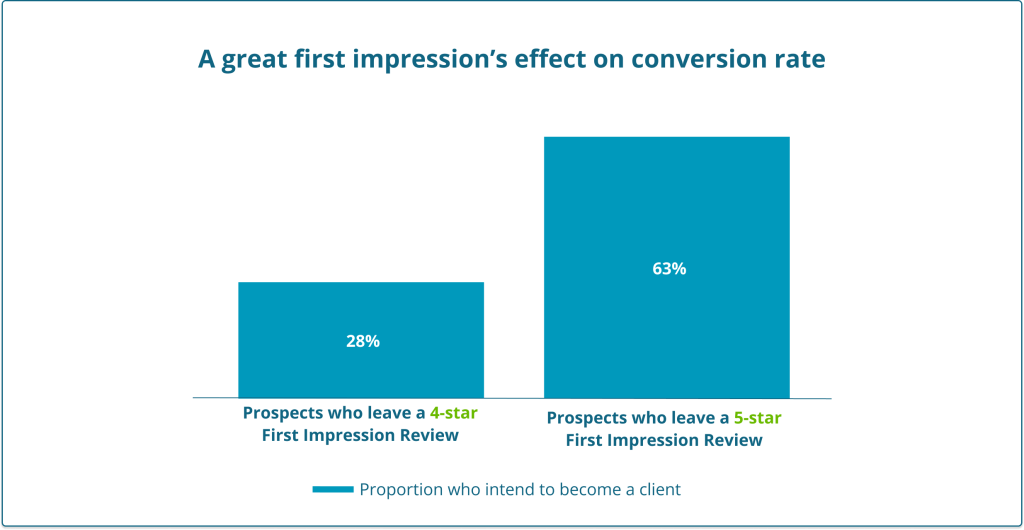

Everyone knows first impressions matter. It’s especially true when meeting a prospect for the first time. That’s why we gather First Impression Reviews after every prospect’s introductory meeting.

As you can see, 63% of prospects who leave a 5-star First Impression Review tell us they intend to become a client. However, this figure more than halves to 28% for those who leave a 4-star review.

The stats speak for themselves. Creating a good first impression is vital if you want to increase your conversion rate and build long-lasting relationships with clients.

How to improve your conversion rate?

So how can you drive improvement and move an average 4 or 4.5 out of 5 rating up to a 5? Our new Safeguard system, which uses feedback and cross-industry insights to help firms improve client experience and mitigate risk, has identified three main ways advisers can make a better first impression and increase conversions.

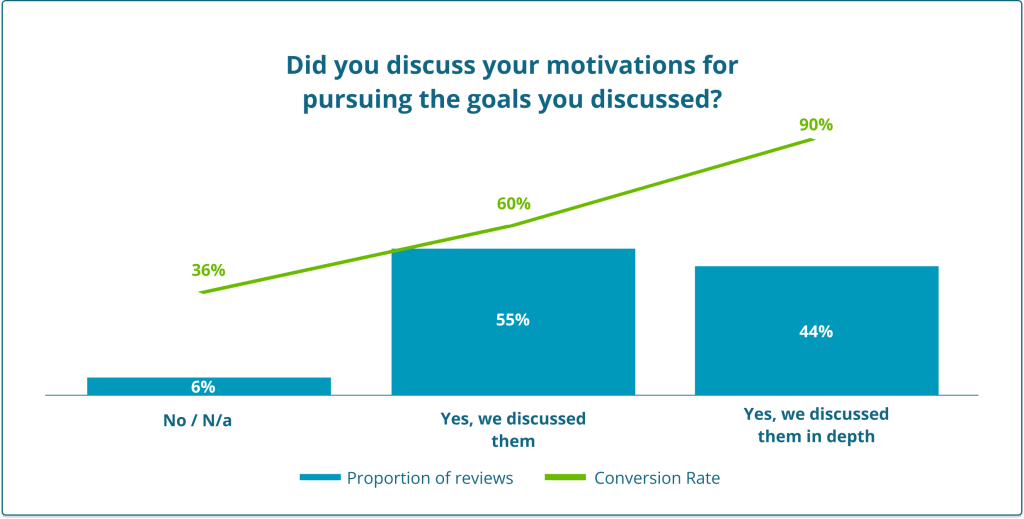

1. Discuss prospects’ motivations in depth

Most people are looking for an adviser who goes beyond what goals they want to achieve (such as comfortable retirement or funding their children’s education) to really understand why they want to achieve them.

The chart below demonstrates how an in-depth discussion of prospects’ motivations in an initial meeting affects conversion rate.

Where in-depth discussions of prospects’ motivations took place, the conversion rate is an impressive 90%. This falls to just 36% where the conversation about the prospects’ motivations didn’t happen at all.

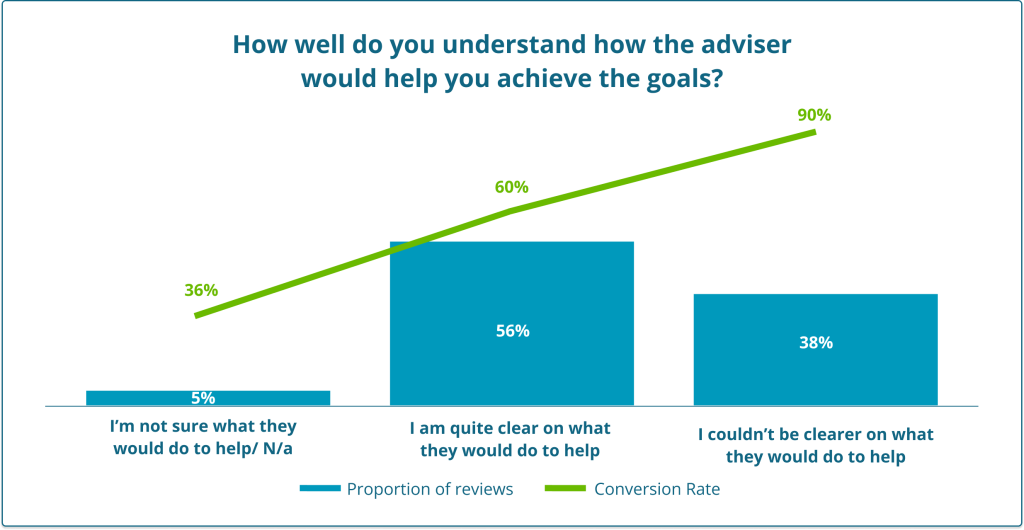

2. Outline clear actions to achieve goals

When choosing an adviser, prospective clients want to hear genuine solutions. They need a clear sense of how you will help achieve their goals.

As the graph below shows, the conversion rate is a robust 85% in cases where the prospect fully understands how the adviser can help them achieve their goals. This drops to just 23% where the opposite is true.

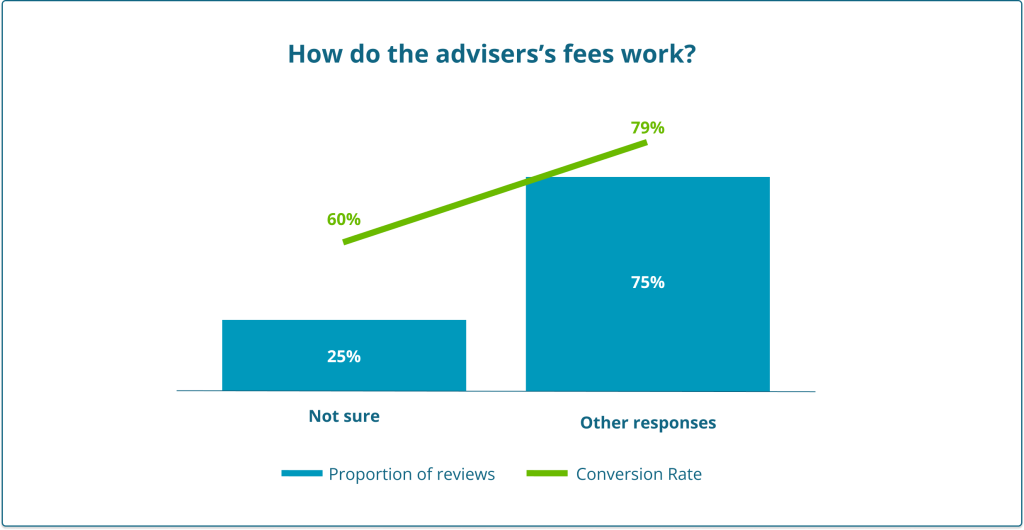

3. Be transparent on fees

Discussing fees can make some advisers uncomfortable, but it’s a vital part of any prospect meeting. Prospective clients are looking for clear communication about your fee structure. If you’re not forthcoming with this information then you risk confusion and your conversion rate will suffer.

The takeaway? Be transparent and clear about your fees to build trust with prospects. There’s no guarantee they’ll go on to become a paying client but, as the chart shows, the conversion rate is notably higher when fees are communicated clearly.