Clear and effective communication has always been important in the provision of financial advice. Clients need to understand the advice that has been given and how the products or service they’re taking meets their needs.

Consumer Duty now takes this a step further, by requiring advisers to evidence that clients receive the right information at the right time, presented in a manner they can fully comprehend to help them make an informed decision.

Elevation data shows that 60% of clients say correspondence from their adviser could be clearer. But clients who say their adviser’s correspondence ‘couldn’t be clearer’ are 1.5x more likely to recommend their adviser than those who say their correspondence is simply ‘clear’. The benefit to advisers, then, is much more than an exercise in satisfying the regulator.

Clarity improves confidence

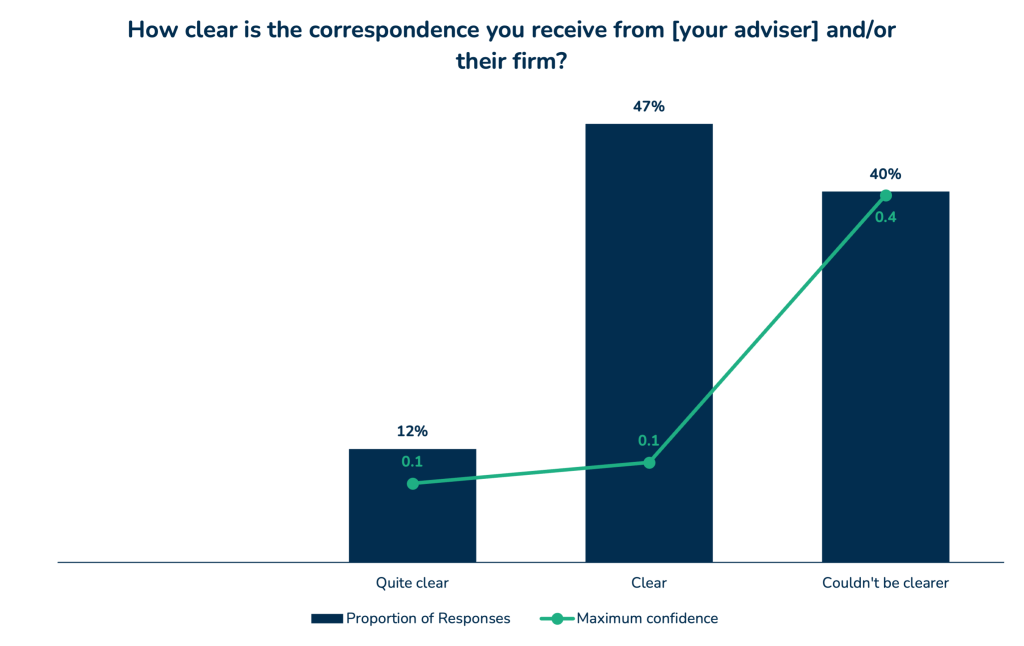

Confidence is needed for clients to be comfortable making an informed decision. Elevation data shows the clarity of adviser communications has a huge impact on the level of client confidence.

Clients who say their adviser’s communication “couldn’t be clearer” feel three times more confident they are on track to meet their financial goals compared to those who find their adviser’s correspondence merely “clear” (40% vs 10%).

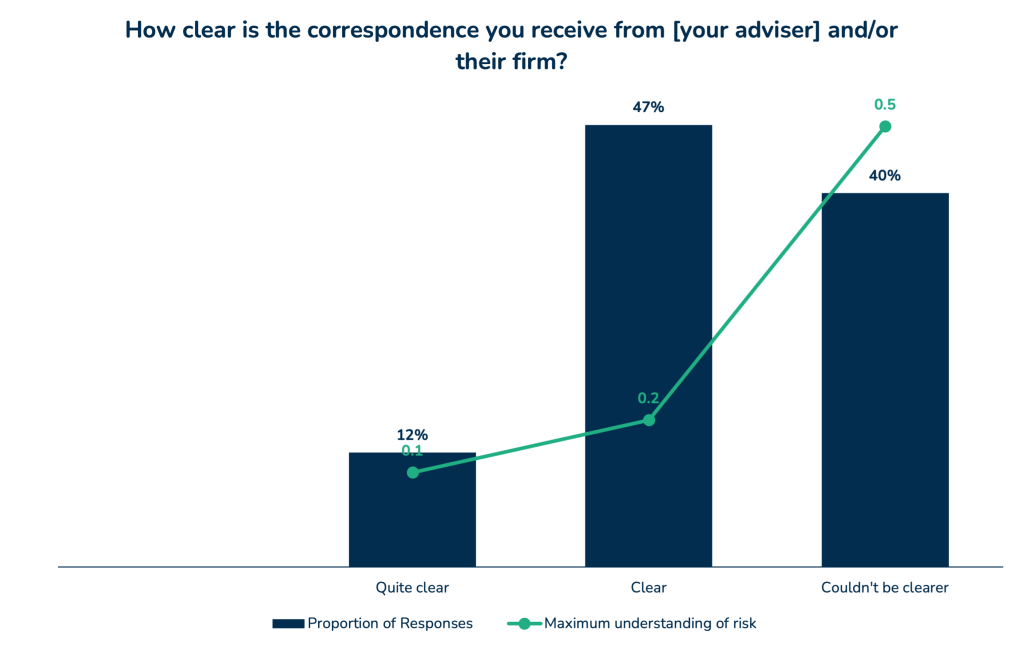

It’s good to feel on track, but it’s even more important to understand the risks associated with the advice.

Clients who say correspondence from their adviser couldn’t be clearer are more than twice as likely to say they “couldn’t be more confident” that they understood the disadvantages associated with the advice (47% vs 20%).

Interestingly, clients who say they took the time to read their adviser’s correspondence in full are 50% more likely to say they have maximum understanding of risk than those who just looked for the most important parts (30% vs 20%).

Commercial advantage

Increased understanding is all well and good, but does it translate to business growth? Elevation data shows that it does: understanding increases client advocacy.

Clients who say correspondence from their adviser couldn’t be clearer are 45% more likely to actively recommend their adviser compared to those who found it just “clear” (1.6 vs 1.1 recommendations per year).

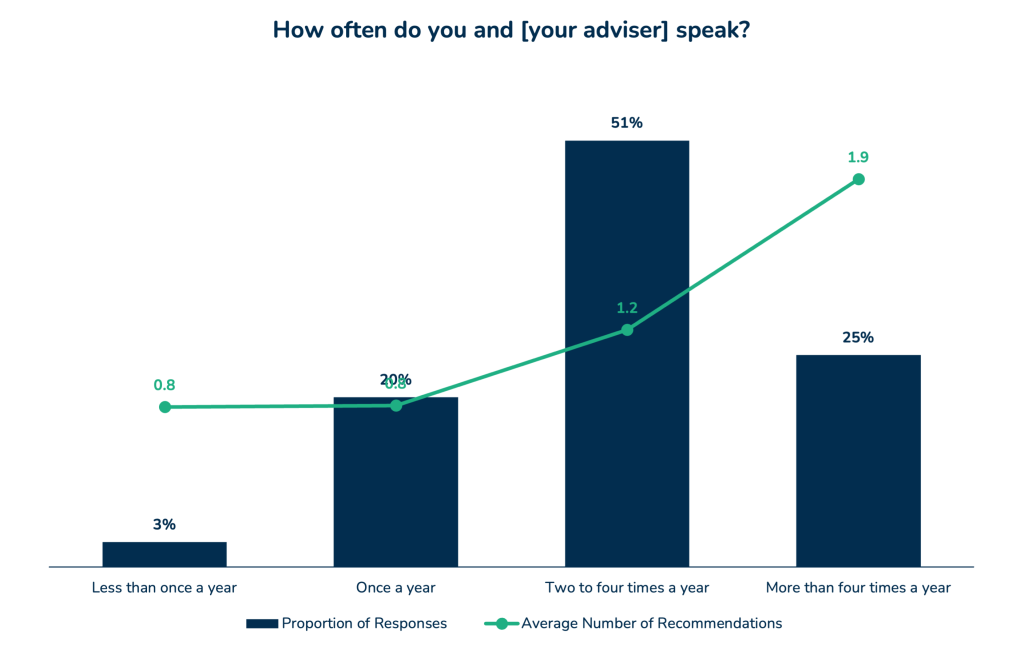

Keep talking

Surprisingly, the biggest impact on client advocacy is the number of times clients communicate with their adviser each year. Clients who have more than four interactions with their adviser each year make 140% more recommendations than those who communicate with their adviser only once a year (1.9 vs 0.8 recommendations per year)

Whilst annual reviews are a good time to check in with clients, much more frequent communications are required to encourage clients to advocate for you passionately..

Using Elevation data, we’ve provided the importance of clear communications for feeling on track and understanding risk. This not only helps client’s make informed decisions, but ultimately increases the likelihood that they’ll recommend you. But how can advisers create better communications to reap the rewards?

Here are 5 things you can do to improve your client communications:

1. Craft clear correspondence: Communications should be written in plain english, without any industry jargon. Aim your writing to be accessible to a 14-15 year old. This is easy to say but often harder to do.

One technique to assess the accessibility of your writing is to ask a junior member of staff to read it and provide feedback. You should also seek feedback on your communications from your clients. Importantly, feedback needs to be regular and acted on to make improvements.

2. Make your communication engaging: Increase the likelihood of your clients reading your correspondence in full by making it engaging. Use visuals like infographics, diagrams, or charts to break down complex ideas. Consider using storytelling to bring to life financial concepts. Ensure that your communications are short, concise and relatable.

A higher engagement rate will improve client understanding. Gauge its effectiveness by measuring the open and click-through rates of your electronic correspondence.

3. Regular interactions: Set a goal to interact with your clients at least four times a year. This could be in the form of face-to-face meetings, video calls, phone calls, text or WhatApp messages, personalised emails or even a newsletter. Regular communication keeps you at the forefront of your clients’ minds and provides ample opportunities to clarify any doubts, explain risk, and fortify their financial understanding.

A great way to implement this could be by setting reminders in your calendar or using a client relationship management system. Assess the success of this strategy by tracking the frequency of client interactions and the resulting increase in client recommendations.

4. Tailor your communications: Conduct a survey to understand your clients communication preferences. From this you can create personas and adjust the communication style and metaphors accordingly. Some clients may prefer digital communications, some more traditional methods. Measure the success of your communications through engagement with the communications and feedback.

5. Put a feedback mechanism in place: Regularly collect feedback from clients. To remove any bias, digital surveys are often best to get an unfiltered view. Importantly, you need to act on the feedback you receive to further enhance your communications and client experience.

The heart of a successful financial advice business rests on its capacity to facilitate client understanding. Better communication is not just a regulatory requirement, but brings tangible benefits to clients’ lives and financial benefits to advisers’ businesses.

By writing clearer communications to help clients understand, advisers are actually securing the future of their business by turning clients into passionate advocates.

The heart of a successful financial advice business rests on its capacity to facilitate client understanding. Better communication is not just a regulatory requirement, but brings tangible benefits to clients’ lives and financial benefits to advisers’ businesses.

By writing clearer communications to help clients understand, advisers are actually securing the future of their business by turning clients into passionate advocates.