VouchedFor’s new Elevation system has analysed over 250,000 client reviews and shows that client confidence has a key role to play. Put simply, the more confident a client feels in their adviser, the more likely they are to recommend them.

But how can you increase your clients’ confidence? This short blog uses Elevation data to reveal the most important adviser behaviours in upping client confidence and the number of recommendations you receive.

But first, a quick word on why client recommendations are so important…

Why client recommendations are vital for your business

Recommendations tell you how satisfied your client is

Client recommendations are an invaluable indicator of how satisfied your client is with your services. There’s no greater compliment than a client recommending your services to someone.

Client recommendations have a higher rate of conversion

From a marketing point of view, client recommendations are like gold-dust. People are far more likely to trust you and become a client if someone they trust recommended you.

Reach similar client demographics

Your existing clients are likely to recommend you to people like them. This means whoever they recommend you to is more likely to fit your ideal client profile and demographic.

Client recommendations require minimal cost

Client recommendations are organic marketing at its very best and most powerful. Generating client recommendations typically requires much less cost than other forms of marketing.

What makes a confident financial advice client?

Unfortunately, simply ‘doing a good job’ and ticking all the boxes doesn’t necessarily translate into confident clients or recommendations. For this reason, we analysed what specifically within a client’s experience motivates them to recommend their adviser’s services.

Being on track to meet their goals

We found that clients who answered ‘I couldn’t feel more confident I’m on track [to achieve my goals]’ recommend their advisers 1.7 times a year on average. This equates to 37% more recommendations than clients who gave an answer that indicated that they could have been more confident.

However, don’t be disheartened. Only 19% of the clients we asked gave the best answer to this question. This means that there is the opportunity to up the confidence of 81% of clients. And, in so doing, generate more recommendations!

This could include formulating clear milestones together with your clients, continually referring back to progress vs goals, and conducting regular reviews. It may sound obvious but directly asking clients how confident they are that they are on track to achieve their goals is important too.

Our Elevation system gathers this feedback for you. It also gives you visibility on how your clients’ answers compare with the rest of the industry, including areas where you’re strongest and areas for improvement.

Having a solid understanding of the risks involved

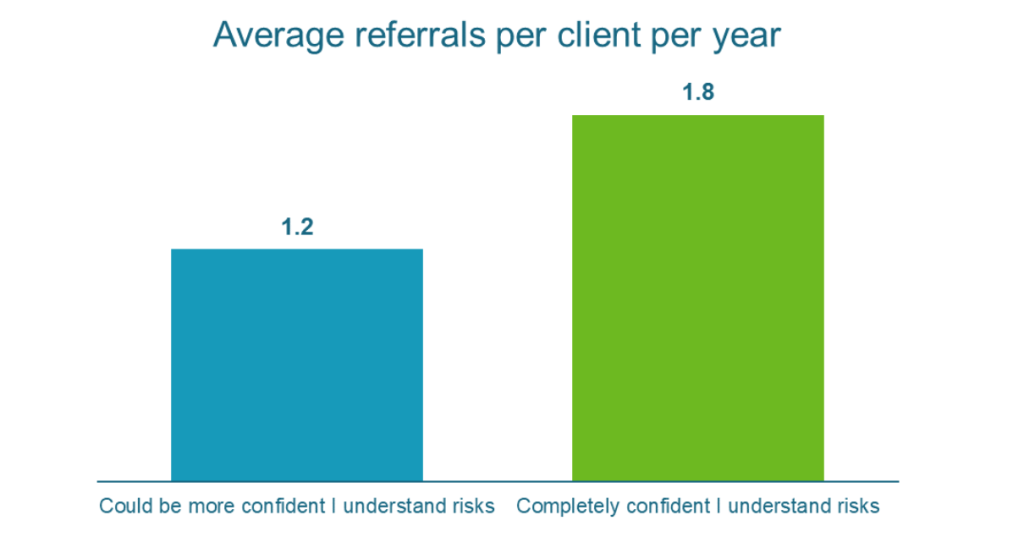

We also found that clients who feel fully informed about the risks associated with their financial adviser’s work would recommend their adviser 1.8 times a year on average. This translates to 50% more recommendations compared to clients who feel they could have a better understanding of the risks involved.

The importance of understanding risk varies depending on the age of the client. Our Elevation data shows that for clients aged 66 or over, full understanding of the risk associated with their adviser’s work makes them 69% more likely to recommend.

Feeling confident?

In conclusion, genuinely confident clients will generate far more of the best enquiries – recommendations. And there are clear steps that most advisers can take to build their clients’ confidence and generate more recommendations.

Here at VouchedFor, we’re passionate about helping advisers deliver and showcase excellent client experience. If you’d like more cross-industry insights from our Elevation system to help improve client experience, we’d love to hear from you.