There’s no getting away from it, Consumer Duty will cost you money.

The new guidelines require firms to record the rationale, data collected, decisions made and actions taken as their whole business.

Savvy firms will introduce efficiencies to balance the cost. But our data shows that by collecting and acting on client feedback in the right way, the average firm could unlock £1.6m additional lifetime revenue through more recommendations and better prospect conversion – massively boosting the return on investment.

Becoming more efficient

Firms will have to review their systems and processes for Consumer Duty. Now is the perfect opportunity to create efficiencies in your processes to offset costs.

To increase efficiency, firms could look to:

- Implement the right technology. Good, integrated technology can make your life much easier by automating tasks and passing data around, which saves rekeying.

- Delegate work. Ask clients to complete their own fact-find via a client portal. This saves time and allows you to focus on soft facts rather than data collection in your meetings.

- Use risk-based compliance. Tune your process to look for anomalies rather than spending time reviewing everything.

- Establish a good data management strategy. You’ll need data for Consumer Duty reporting so use integrated systems which produce usable data reporting.

Get a positive ROI: how to make consumer duty work for you

Data from Elevation, our enhanced client survey, shows that embracing the principles of Consumer Duty improves the client experience, which leads to increased profitability.

Consumer Duty says that advisers must “act to deliver good outcomes for consumers”. Put simply: help clients achieve their goals. Unless you define a client’s goals, you can’t report on how you’ve acted to deliver them.

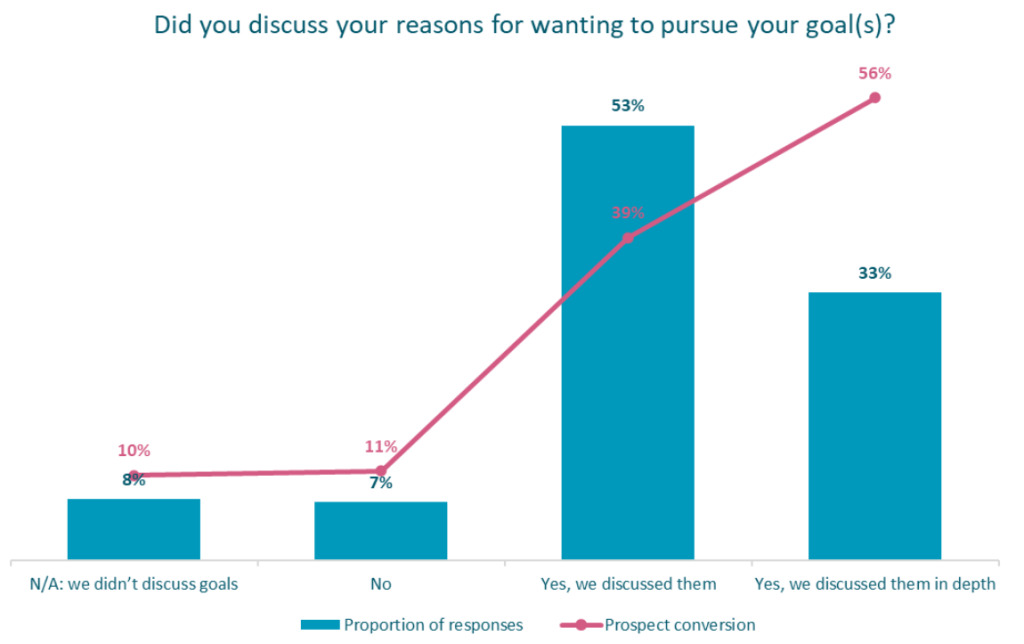

Focusing on a prospect’s goals and motivation makes it clear you’re on the case to help them. In fact, Elevation data shows that focusing on a prospect’s goals leads to a 43% greater chance of them becoming a client.

What you can do:

- Keep asking “why” until you get to their real motivation

- Repeat things back to the client to show you’ve listened and understood

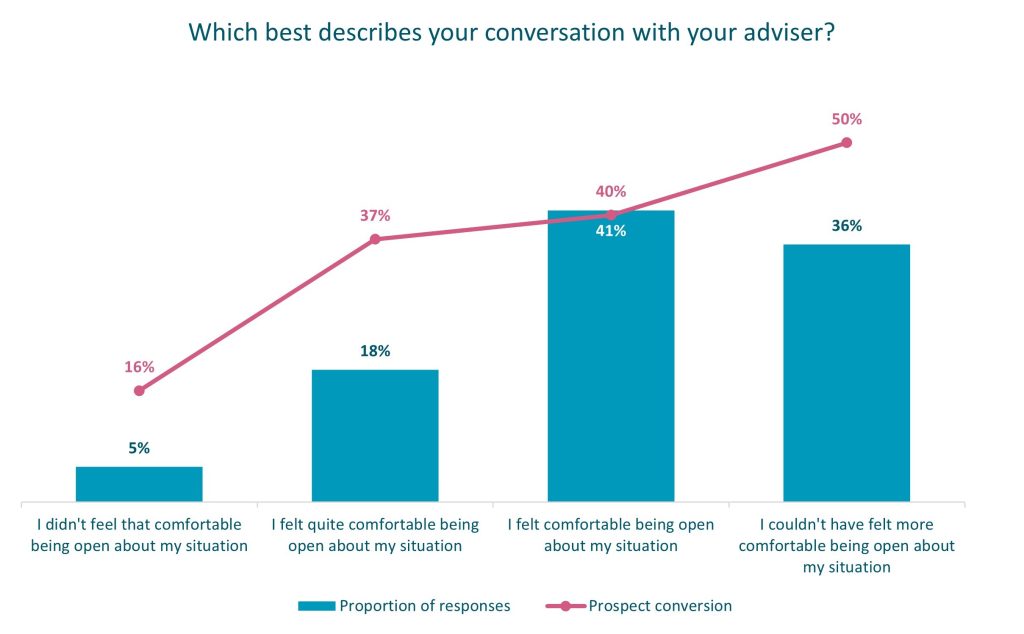

Clients need to be relaxed to tell you what they really want. If a prospect is comfortable opening up to you, they’re 25% more likely to become a client.

What you can do:

- Start conversations talking about your client’s goals and motivations, rather than money.

- Use “what are you looking to achieve” rather than “how can I help” – this focuses the conversation on goals rather than transactions.

Get these two areas right and you’ll not only meet Consumer Duty, but you will also increase your conversion rate by over 50%.

What about boosting client referrals?

The Consumer Understanding outcome requires that clients have the right information, at the right time, to make informed decisions. Elevation data shows that clients who feel your communications “couldn’t be clearer” recommend you 45% more often than those who aren’t as certain.

What you can do:

- Keep communications easy to read. Free online tools can tell you the reading age of text – the lower the better. Ensure you remove any sensitive information (names, addresses, etc) before using online tools.

- Write a summary on the first page of documents. This makes important information more accessible.

The Consumer Support outcome requires clients to be able to use their services as reasonably anticipated. A large part of which is being able to access their adviser when they need them. If your client feels you’re accessible, they’ll recommend you to 30% more.

What you can do:

- Be clear that your client can contact you whenever they need you (assuming your ongoing service includes this).

- Reach out to clients just to say hello. Calling with no agenda shows that you can talk outside of formal meetings.

What gets measured gets managed

Monitoring progress will keep advisers focused. To maximise the commercial opportunity in Consumer Duty, firms need to reset their KPIs to focus on client outcomes.

An outcomes focus leads to a better client experience, which in turn drives increased recommendations and improved conversions. This means better profitability.

Because Consumer Duty outcomes are so subjective, the best way to set and measure KPIs is through client feedback.

This belief was the founding principle for our enhanced client survey, Elevation.

Powered by 250,000 clients’ feedback, Elevation shows advice firms and advisers the specific actions they can take to meet the Consumer Duty and drive revenue growth.

That’s why more than 1,000 advisers from leading advice firms have chosen Elevation as their preferred survey solution for Consumer Duty.

Embrace Consumer Duty – it’s worth it

Becoming Consumer Duty ready will carry a cost. Yet, by doing it properly, you can improve your client experience and profitability.

On average, advisers who apply all the insights from Elevation could earn 13 additional clients each year, worth a total lifetime value of £325,000. So for the average five-adviser firm, a better experience could unlock an incredible £1.6m.

To succeed, you’ll need to track your client experience. To find out how Elevation can help you, or if you’re interested in getting more content to help you meet your Consumer Duty, contact elevation@vouchedfor.co.uk