Consumer Duty recognises the importance of protecting customers in vulnerable circumstances. Vulnerability can arise from a variety of factors such as age, disability, health conditions, low financial literacy, or social circumstances. According to the FCA, a vulnerable consumer is someone who, due to their personal circumstances, is especially susceptible to harm, particularly when a firm is not acting with appropriate levels of care.

Meeting the needs of vulnerable clients should not just be a regulatory requirement, but an ethical responsibility.

Elevation data highlights five areas to help advisers create an environment where vulnerability is understood, identified, catered for and evidenced. By creating a culture of care, advisers can promote trust, foster long-term relationships, and enhance the well-being of their clients.

- Training

Invest in training for advisers and support staff to help them identify and understand vulnerability and respond appropriately. This includes training on physical and mental health awareness, low financial literacy, language barriers or cognitive impairment.

Whilst conducting a vulnerability assessment as part of the fact-finding process is crucial, all staff should play a part in identifying and adapting to best help vulnerable clients.

Providing your staff with the necessary skills and knowledge will help them build trust with vulnerable clients. It will also ensure vulnerable clients receive the support they need and help achieve good outcomes. - Creating the right environment for clients to be open

Vulnerability assessments are a waste of time if the client doesn’t feel comfortable being open about their situation. A good way to understand this is to add a question to your client survey like ‘How comfortable did you feel being open about your situation?’

Those who do open up generally feel more on track to achieve their goals. Only by understanding your client’s real hopes and fears, can you make great recommendations.

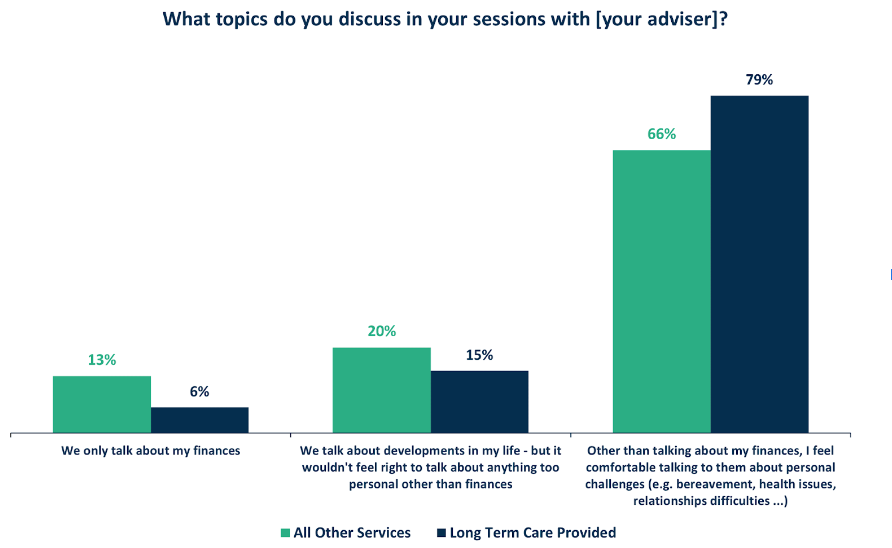

Elevation data shows that clients who receive long-term care advice are more comfortable being open about their issues (13% more than average), and also feel more on track to meet their goals (5% more than average). It may be that their situation necessitates these clients being open about their needs. Others with new or temporary vulnerabilities may need more help to share their personal challenges.

3. Make risk understandable

Everyone has a different understanding of risk based on their experiences and circumstances. Vulnerable clients may find it harder to understand risk so try to use explanations your client will understand. It’s critical that clients understand risk, so ask them to play back to you key points to make absolutely certain they understand.

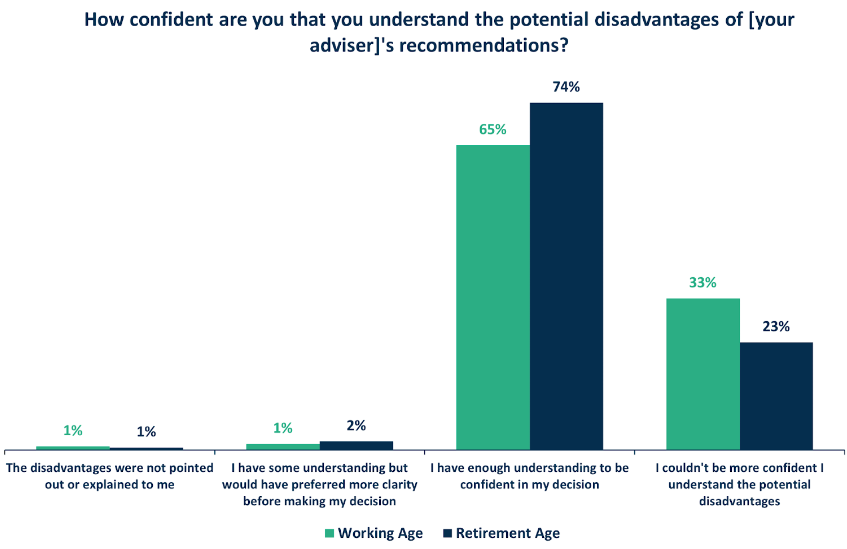

Both the importance of risk, and understanding of it, changes with age. Elevation data shows that although clients over the age of 65 feel they have enough information to make decisions, extra care is needed when dealing with this age group. This group of clients are 10% less likely to say they “couldn’t be clearer they understand the potential disadvantages of the advice”.

4. Communication

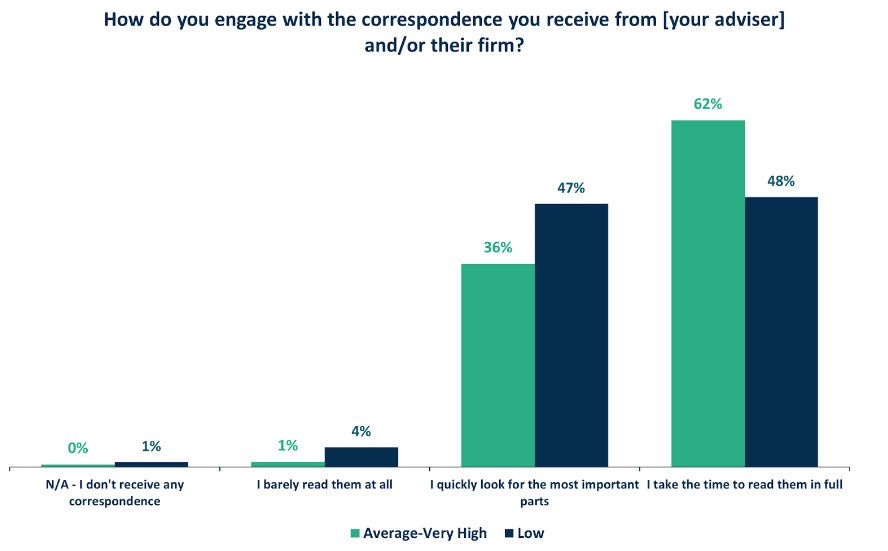

Clear and simple communication helps vulnerable clients to understand your advice. Elevation data shows that clients with low financial knowledge are less likely to read correspondence in full (48% vs 62% with moderate to high financial knowledge).

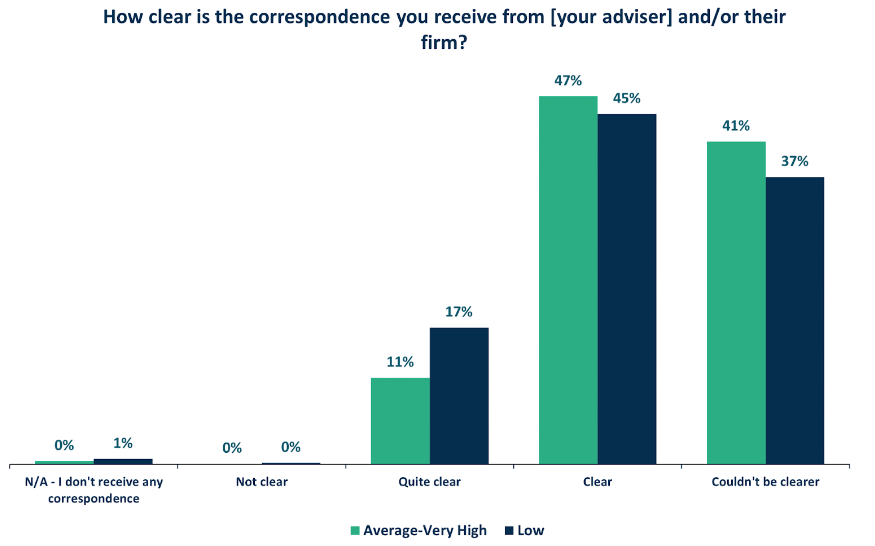

Crucially, they’re also less likely to understand what they read. Clients with low financial knowledge are 6% more likely to say they find documents only “quite clear” and 4% less likely to say correspondence “couldn’t be clearer”.

Make text easier to read by:

- using plain language

- avoiding jargon

- breaking up large chunks of text with headers

- bullet points

- underlined text

- charts

- pictures

Tailor communication to the individual needs and preferences of your clients. If your client has poor eyesight, an audio recording of your report may be easier to understand. If they find it hard to concentrate due to adult ADHD, or similar conditions, a video recording of you explaining the advice could help.

And don’t forget to stay in touch. Elevation shows clients over 65 are less likely to speak to their adviser more than once a year, so make sure to check in with them regularly.

5. Continuous improvement

Identifying and adapting to meet a client’s vulnerability is just the start. Review and evaluate your processes regularly to identify areas for improvement. This includes monitoring client feedback, outcomes, and complaints.

Meeting the needs of vulnerable clients has always been important for financial advisers. Consumer Duty now makes it critical to be able to show how you’ve met their needs and that they’ve received as good outcomes as non-vulnerable clients.

Using the five areas in this article, advisers can improve their vulnerable client processes and procedures. Elevation makes it easier to record and report on your progress as you create a business that’s great for vulnerable clients to engage with.

___________________________

Elevation is an enhanced client survey from VouchedFor. It uses client feedback to drive business growth. Powered by 250,000 clients’ feedback, Elevation shows advice firms and advisers the specific actions they can take to meet the Consumer Duty and drive revenue growth.

Elevation offers completely private feedback, industry benchmarks, and a real-time Consumer Duty Report. That’s why more than 1,000 advisers from leading advice firms have chosen Elevation as their preferred survey solution for Consumer Duty.

To find out how Elevation can help you, or if you’re interested in getting content to help you meet your Consumer Duty, contact elevation@vouchedfor.co.uk