Financial literacy plays a critical role in ensuring clients make informed decisions, ultimately leading to better financial outcomes. But is it an adviser’s job to educate clients? And if so, how much do clients need to know?

Today, we look at the financial adviser’s role as an educator, how financial literacy affects engagement and decision making, and what you can do to help your clients understand.

Consumer Understanding

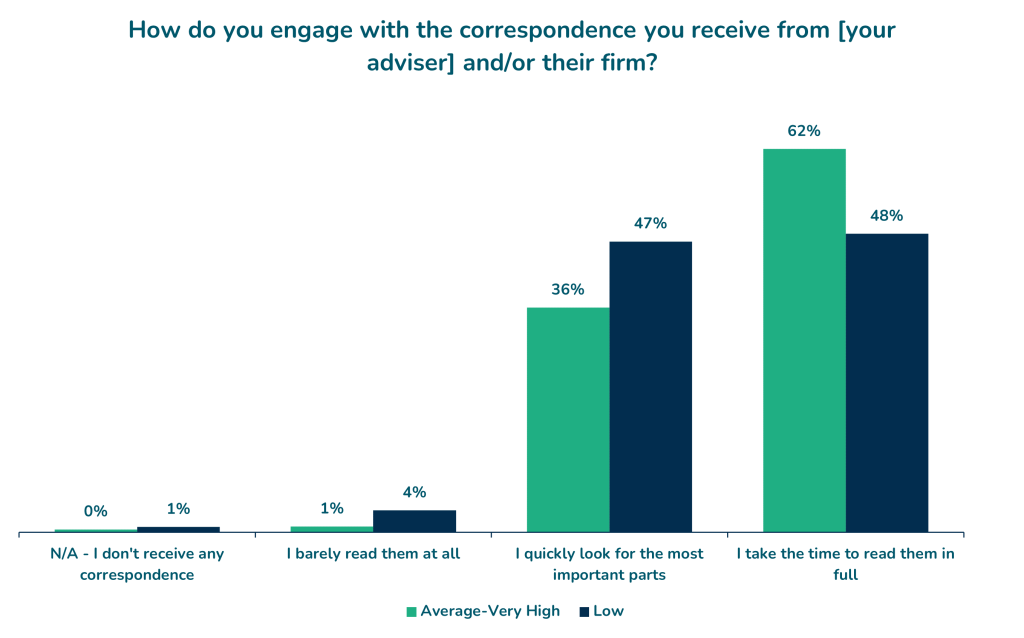

Ensuring a high level of client-understanding is an outcome in the FCA’s Consumer Duty. Elevation data shows that clients with lower-than-average financial literacy are 23% less likely to read correspondence from their adviser in full, and three times more likely to “barely read it at all.” By not engaging, there’s less chance of them following a financial plan.

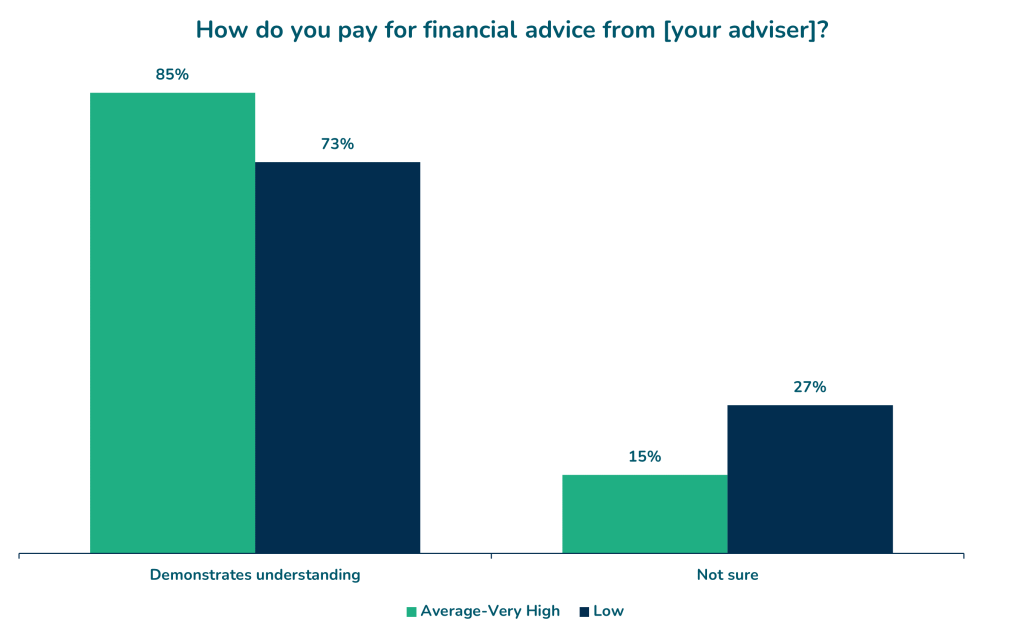

Additionally, clients with lower financial literacy are 44% more likely to be unsure of how they pay their adviser compared to those with average to high financial literacy, leaving them struggling to know if they’re getting “fair value”.

This lack of understanding can hinder their ability to make informed decisions, negatively affecting their experience and financial journey. But is educating clients an adviser’s job?

Morven Grierson, Compliance Director at MKC Wealth Management believes it is. “I think it’s fundamental and is a really key point for Consumer Duty in respect of the Communications and Support outcomes. If we don’t educate our clients, how are our clients supposed to know what we’re trying to achieve for them?”

Grierson believes that education shouldn’t stop at products but should also include a client’s behavioural biases. Speaking about clients, she says “Am I going to panic when the markets go crazy? Am I going to want to pull all my money out? We need to know that as financial advisors. We need to know how you are going to behave so we can target our communications to the right people at the right time. It’s what the FCA expects”.

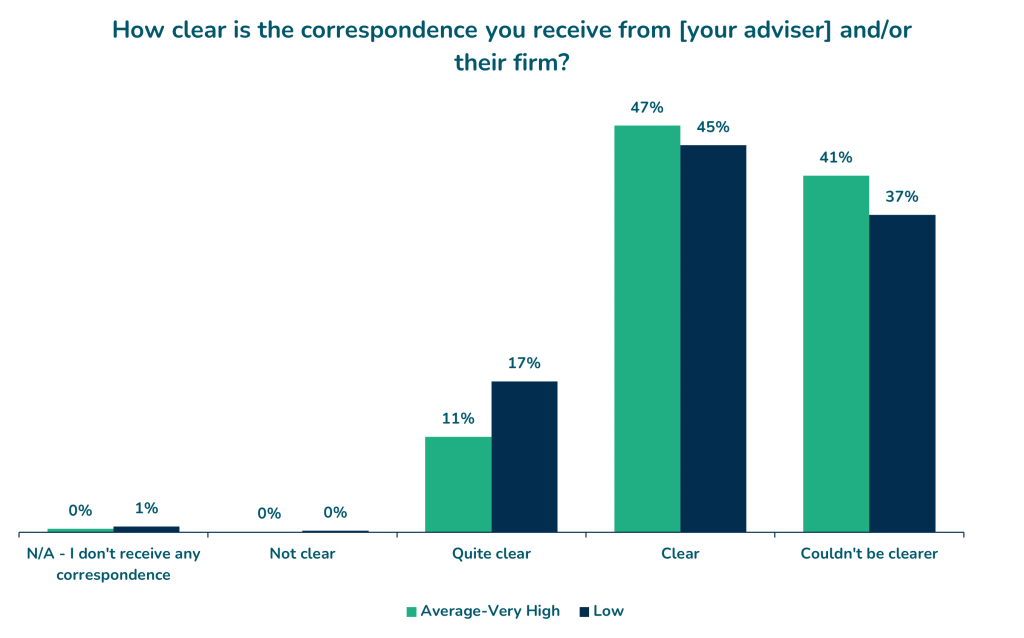

Clients with low financial literacy are less likely to say correspondence was clear or couldn’t be clearer than those with average to high financial literacy.

However, improving financial literacy shouldn’t be the primary goal of engaging with an adviser, argues Rachel MacRae, Compliance Consultant at B-Compliant. “It’s about giving (clients) the information they need, not teaching them to be a financial adviser.” She adds, “It’s about the destination, not the journey,” emphasising that clients need to understand the decisions they’re making and why, but not the detail behind everything.

Advice from advisers

Taking clients on the journey and involving them in the planning process can help clients grasp their financial situation better. Darren Bilkey, financial adviser at Trusted Financial Advice, suggests, “[involving] your clients as much as possible in the actual planning. It’s a collaboration.” Bilkey believes that by encouraging clients to take an active role in their financial planning, they’ll naturally become more financially literate and have a better understanding of their decisions. He’s also an advocate of using cash flow modelling to help clients visualise their plan and advises, “Don’t tell people that they’re going to be okay. Show them.”

Another approach is to assign “homework” to clients before meetings, ensuring they’re engaged and prepared for the discussions. Jo Baker, financial adviser at Yorkshire Financial Planning, emphasises the importance of sending out homework in advance. “Sending out a budget planner and getting it done in advance”, Jo says allows the adviser to “focus as much of the meeting as possible on what the client wants to talk about, which is ultimately them and not the stuff that they already know.”

7 tips to improve client understanding:

- Encourage client participation in the planning process: collaborate with your clients and ensure they play an active role in developing their financial plan. This involvement will foster increased financial literacy and a better understanding of the decisions they’re making.

- Assign homework before meetings: by sending out fact find requests, budget planners or other relevant materials in advance, clients will become more engaged in the process and ready to discuss their financial goals and concerns.

- Establish a feedback loop: encourage clients to provide feedback on your services and their understanding of their financial plan. This will allow you to identify any gaps in their knowledge and adjust your approach accordingly. Survey platforms like Elevation make this easy to do.

- Communicate clearly, simply, and appropriately: ensure your correspondence is clear and easy to understand. Avoid jargon that may confuse clients with lower financial literacy and adapt your style to meet the needs of your clients.

- Repeatedly check clients’ understanding: regularly ask your clients to explain their financial plan to you. This will help you see how much they understand and where to provide additional support.

- Offer educational resources: provide clients with access to articles, webinars, or workshops that cover relevant financial topics, helping them to build their knowledge and confidence in their financial journey.

- Celebrate progress and achievements: acknowledge the milestones and accomplishments of your client throughout their financial journey. This reinforces the value of the plan and gives them a sense of pride in their increasing financial literacy and understanding.

Implementing these strategies will not only enhance the client experience but also foster a more informed and engaged client base. By prioritising financial literacy and involving clients in the planning process, you will be better equipped to help them navigate their financial journey and achieve their goals.

Remember, the key to success lies in finding out how your clients feel and the best way to do this is to ask them. Elevation is an enhanced client survey from VouchedFor. It uses client feedback to drive business growth. Powered by 250,000 clients’ feedback, Elevation shows advice firms and advisers the specific actions they can take to meet the Consumer Duty and drive revenue growth.

Elevation offers completely private feedback, industry benchmarks, and a real-time Consumer Duty Report. That’s why more than 1,000 advisers from leading advice firms have chosen Elevation as their preferred survey solution for Consumer Duty.

To find out how Elevation can help you, or if you’re interested in getting content to help you meet your Consumer Duty, contact elevation@vouchedfor.co.uk