Fixed fees have been around for a long time. Some advisers have been working on a fixed fee basis, with success, since long before the Retail Distribution Review (RDR). Whilst the FCA has not prohibited charging a percentage of assets, they regularly express a preference for fixed fees when speaking to the adviser community. Advocates of fixed fees have also commented that they will professionalise financial advice in the eyes of the general public.

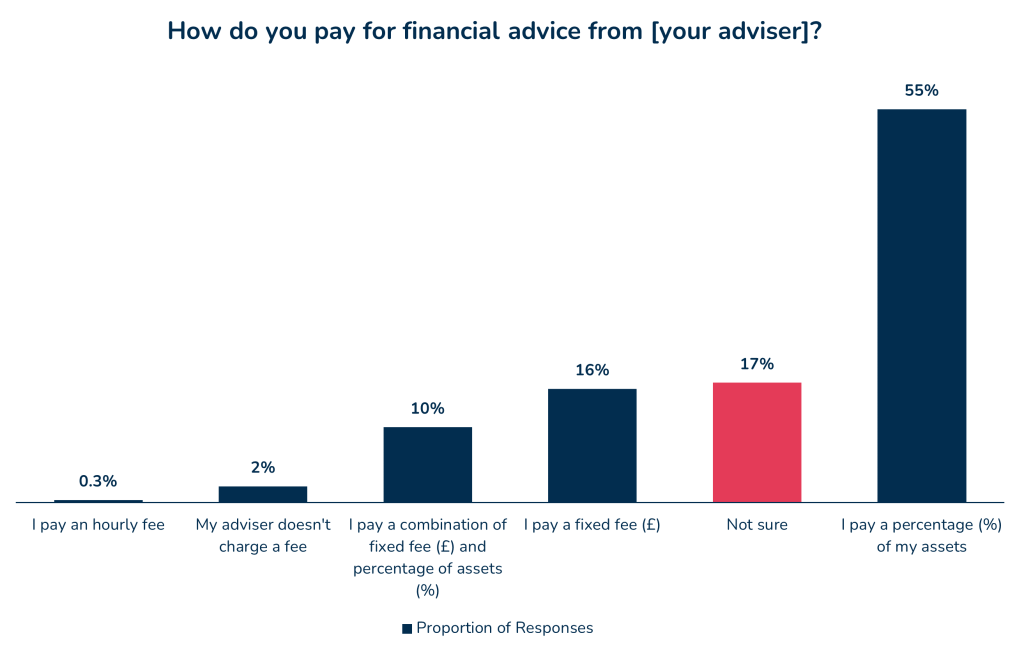

Despite this, the vast majority of advisers still charge clients a percentage of their assets. Elevation data shows that only 17% of clients pay a fixed fee for their financial advice.

Whilst Consumer Duty stresses that justifiable prices are more important than the actual method of remuneration, we’ve delved into Elevation data to assess the real impact charging fixed fees has on the client experience and if it’s right for everyone.

What am I paying?

Despite the stringent disclosure requirements on fees, staggeringly 1 in 6 clients are still unsure how they pay for financial advice. Perhaps more worryingly, 2% of clients say that their adviser doesn’t charge them a fee.

This may be, in part, down to how advisers disclose their fees. A reason Consumer Duty places such emphasis on consumer understanding.

Fixed fees and the client experience

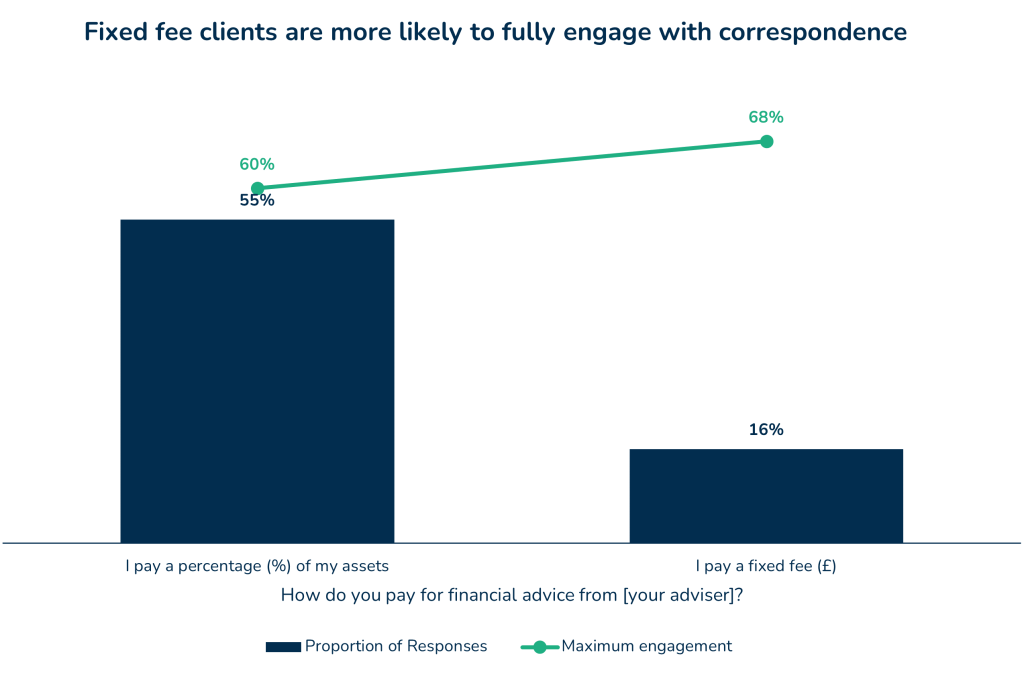

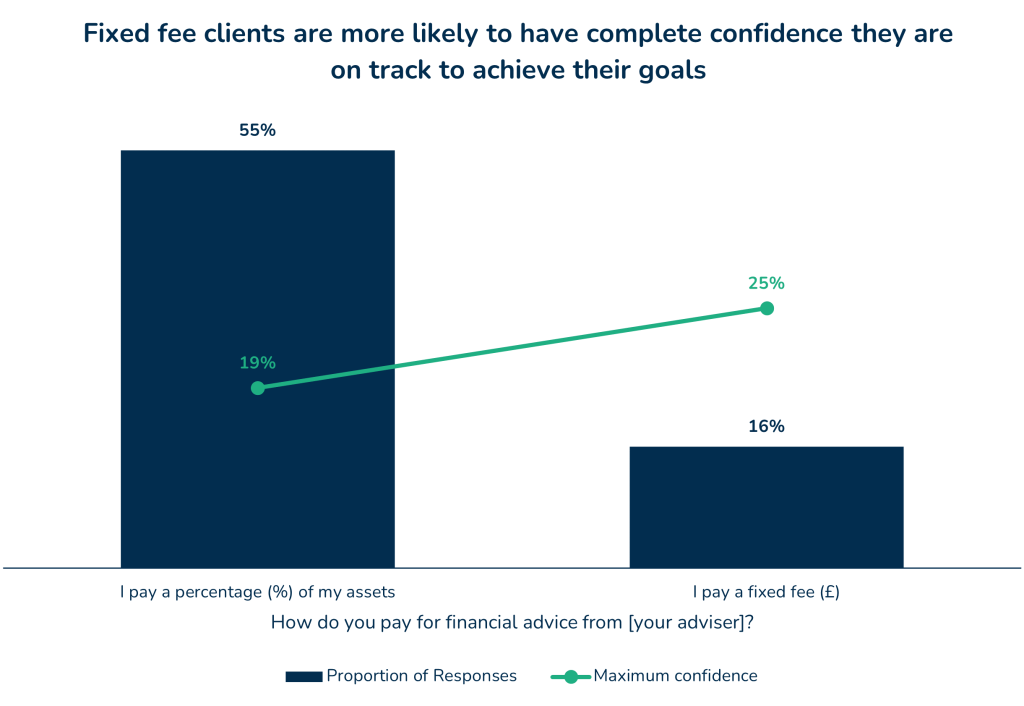

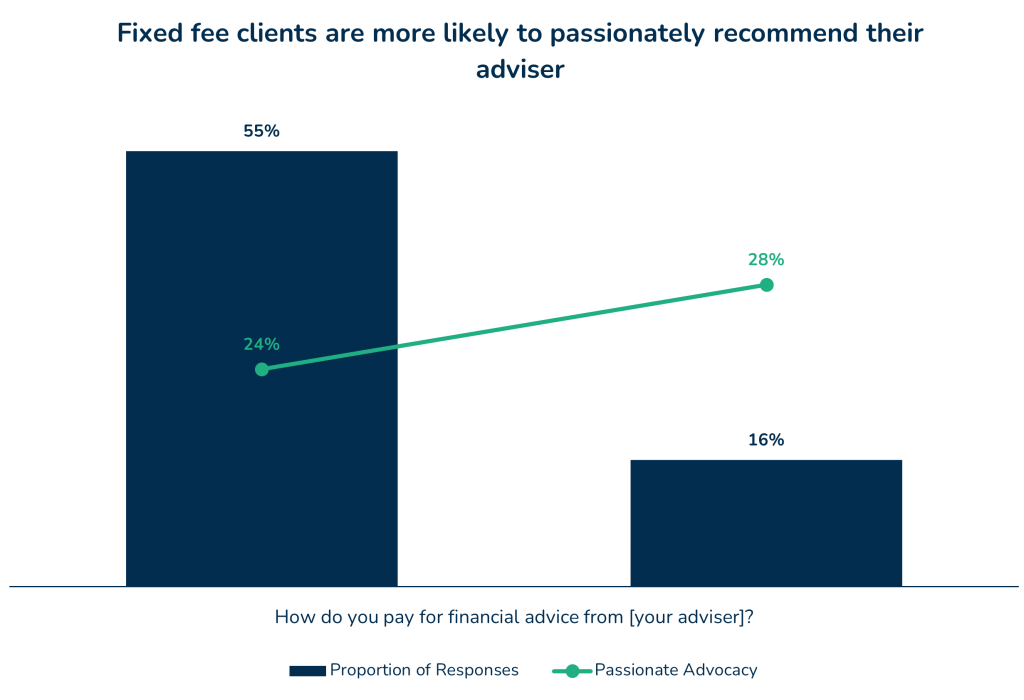

It’s hard to deny that fixed fees are easier than percentage-charges for clients to understand, but do they make an impact on the client experience? Elevation data shows that clients who pay a fixed fee rather than a percentage of assets are more likely to say:

1. They engage fully with correspondence

2. They couldn’t be more confident they’re on track to achieve their goals

3. They would passionately recommend their adviser

Whilst this data appears to support the case for fixed fees, they might not be right for everyone.

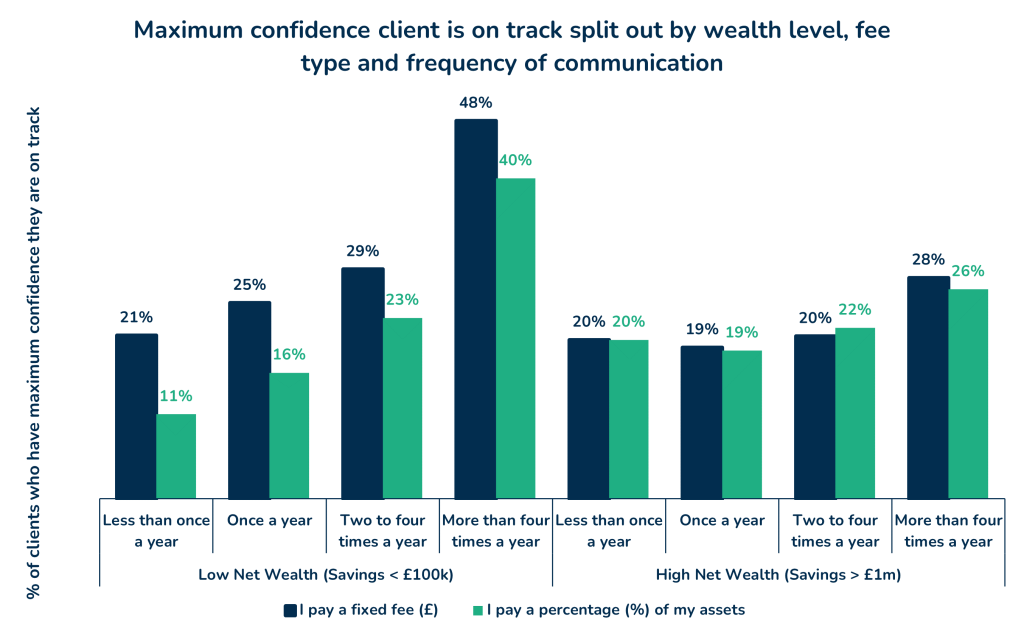

For clients with less than £100,000 invested, charging a fixed fee significantly improves confidence they’re on track to achieve their goals. This would suggest fixed fees represent more value for this type of client. Perhaps because the visible exchange of money gives more incentive to engage in the process.

However, for clients with over £1m invested, fixed fees have no real effect on their level of confidence, indicating they don’t value this charging method.

Interestingly, for both audiences, the number of interactions with their adviser each year had an impact on how “on track” they felt. This was particularly pronounced in clients with less than £100,000 invested, suggesting that the service received could be more important than the way it’s paid for.

Fixed fees and the Consumer Duty

Despite the FCA’s preference for fixed fees, percentage of asset charging is still permitted. The Consumer Duty raises the bar for advisers requiring them to justify how they have decided their fee represents fair value.

This is generally easier for fixed fees as the fee is usually roughly based on the number of hours anticipated to complete the work. For percentage of asset charging, this justification can be more challenging as the amount of work on a large case rarely increases in line with the increased fee received. Despite the arguments for and against fixed fee, advisers are still permitted to charge a percentage of assets, providing they can justify it provides fair value to clients.

One thing to avoid is complex charging structures. In search of fair value, some firms are toying with hybrid charging structures. These mix fixed fee and percentage of assets, sometimes with gates, tiers, or caps. However, the more complex the charging structure is, the less likely clients are to understand it.

Our tips to create fair value:

- Give clients an option

Elevation data shows that for some clients, a fixed fee adds to the overall experience. For others, it has no impact. Having both fixed fee and percentage of asset charging available, and promoted equally, allows clients to select the best fit for them. Using the firm’s own data from Elevation can help identify which segments would be more likely to benefit from fixed fee vs percentage-based charging.

- Keep it simple

The more complex the charging structure is, the less likely clients will understand it. Combinations of fixed fees, percentage charging and fee tiers and can seem like great ideas to create fair value. However, complexity can impact the client’s understanding of how they are paying, therefore lessen their engagement in the process.

- What the service delivers is more important than how it’s charged

Creating a service which creates value for clients is more likely to have a positive impact than the way it’s charged for. Keeping clients engaged through regular communications and check in calls can have a big impact on how engaged they are in the process and how “on track” they feel.

In this era of increased scrutiny and emphasis on fair value, the fixed fee approach could help with fair value assessments; but this is not by any means right for all. It seems that despite Consumer Duty, fixed fees vs percentage of assets charging will remain an ongoing debate.

Creating both fixed fee and percentage of asset charging options gives clients a choice of what would work best for them. When designing a proposition, analysing client feedback will help show which segments would value fixed fee charging the most. Above all, keeping charging simple and always working on the basis that delivers most value to clients will help firms navigate the fair value maze.