Advice firms who neglect to invite all their clients to give feedback are only cheating themselves, says Rob Heath, Director of IronMarket Wealth, after recent Elevation data highlighted areas for the firm to improve relating to the ‘Price and Value’ and ‘Consumer Understanding’ outcomes of the Consumer Duty.

IronMarket is a Wealth and Investment Management firm, founded in 2013, which is challenging the industry’s status quo. For starters, Rob set out a clear expectation at the start of the year that all IronMarket’s members (how IronMarket reference clients) would have the opportunity to give feedback after every meeting with their ‘wealth mentors’ (how IronMarket reference advisers).

“Receiving regular feedback, both positive and developmental, is key in our pursuit of excellence,” Rob says. “It’s pretty easy to maintain a 5* rating when you cherry-pick the members you ask for feedback, but we wouldn’t be exceptional with that mentality.

“It’s only by asking all our members for feedback that we can uncover our blind-spots and identify areas which need improvement. This kind of feedback is a gift, and any firm which thinks otherwise is only cheating themselves,” he continued.

IronMarket has chosen to work with Elevation, VouchedFor’s enhanced client survey, to collect and analyse member feedback. The firm’s wealth mentors already had public profiles on VouchedFor, the consumer-facing review site.

Using Elevation, firms can collect 100% private feedback, and see how their performance compares with industry benchmarks against each of the Consumer Duty outcomes.

Since mandating that all members are invited to give feedback, Rob, and IronMarket’s mentors, have had to address some development areas.

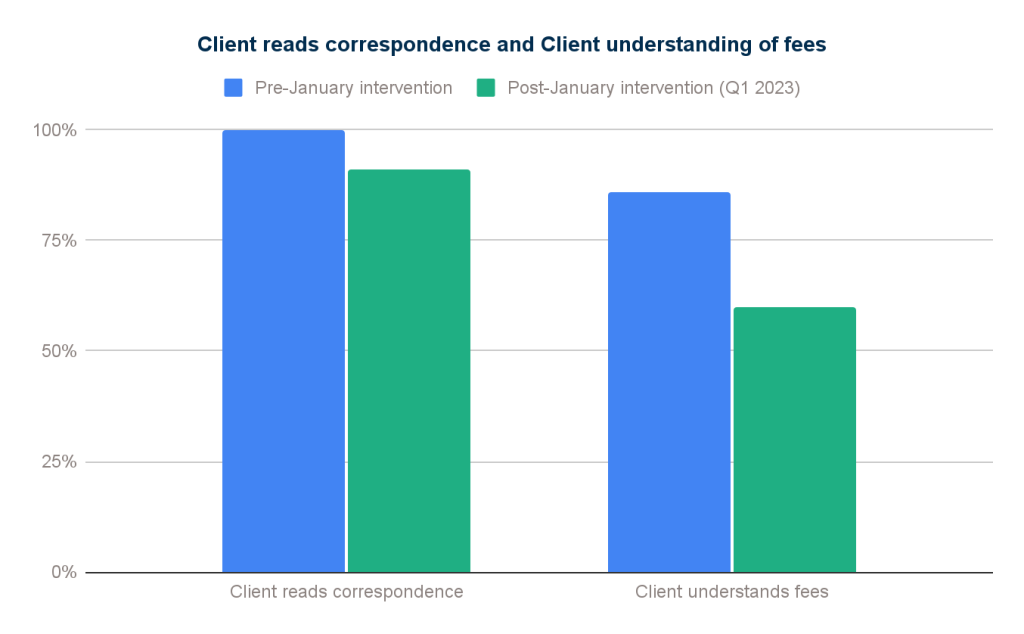

Prior to the January decision, 100% of the members whom IronMarket asked for feedback said that they read the firm’s correspondence either “in full” or “in part”. After inviting all members to give feedback, this number fell in Q1 to 90.91%.

Members who showed an understanding of their fees also fell, from 86% to 60%.

Rob saw both these shifts as evidence that IronMarket was doing the right thing.

“Yes, two of the data points moved in the ‘wrong’ direction,” he says, “but that highlighted a hugely important opportunity for us to give our members a better experience and to reduce the potential for risk within our business.”

IronMarket embedded a slick process for remediation, whenever they received feedback that highlighted an issue.

“If we got feedback from a member – for example telling us that they don’t understand how their fees are paid – our wealth mentors would contact them immediately, understand what areas weren’t clear and ask the member to articulate the information back to them. Our mentors logged this interaction on our CRM to evidence they’d had the conversation, and that our member’s understanding had been clarified and verified in this area, supporting Consumer Duty expectations.

“We were then able to enhance our process to be proactive, so we don’t need to remediate. Many of our members have been with us for a number of years – they don’t regularly consider how they pay their fees. We’ve built it into performance reviews that our wealth mentors should check members’ understanding in their meetings – even annual meetings with long-standing clients – and have the member replay to them key areas such as fees and risk parameters.”

Rob reviews Elevation data every day to monitor and evidence improvement, to make sure that the actions they’ve taken are having the desired effect.

The results have been exemplary. Since IronMarket identified the development opportunity at the end of Q1, and implemented these new processes, the percentage of clients who show an understanding of their fees has leapt to 91.43% – so the firm is doing better than it was in 2022.

The firm has taken a similar approach to their scores on correspondence. “We’ve reviewed our correspondence, and what our suitability reports look like, so that we can make it more engaging for people to read,” says Rob, speaking to a process which has involved a multi-functional team of paraplanners, marketing, and senior leadership. “Our suitability report (including appendices) has recently been reduced from 25 to 16 pages, with further enhancements planned, to be more ‘member friendly’. It’s a balance: visually, it needs to encourage members to read it, but the content must also cover the advice sufficiently and therefore be compliant.

IronMarket’s approach to member feedback leaves them confident in meeting Consumer Duty requirements and growing revenue in the months ahead, says Rob.

“We welcomed the Consumer Duty regulations when they were published, and we’re comfortable that we’re already meeting requirements. For us, putting members at the heart of our business is ultimately what we do and what we believe. Our business has grown 22% in the last 12 months, and we’re forecasting higher growth in the months ahead.”

Elevation, from VouchedFor, is an enhanced client survey, driving business growth.

Powered by 250,000 clients’ feedback, it identifies which factors make the biggest positive difference to client experience, and uses carefully engineered questions within a client survey to reveal how advice firms are tracking against them.

Elevation helps you drive advocacy from existing clients, improve conversion of prospective clients, and mitigate risk by identifying issues early. It can also form part of your ongoing response to the Consumer Duty.

To find out how Elevation can help you, or if you’re interested in getting content to help you meet your Consumer Duty, contact elevation@vouchedfor.co.uk

To learn more about IronMarket Wealth, please visit our website – https://www.net-worthntwrk.com/ or contact Rob directly – rh@ironmarketwealth.com