IronMarket, a Wealth and Investment Management firm that is redefining their members’ expectations of advice firms, drove a 23% increase in maximum member confidence since January – a period in which the industry average stayed static – according to data from Elevation, VouchedFor’s enhanced client survey.

IronMarket, founded in 2013, believe that putting ‘members’ (how IronMarket refer to clients) at the heart of their business creates a better experience, building trust and advocacy. The firm adopted Elevation in August last year to help embed a culture of excellent member experience through measurement, analysis and action. The client feedback collected by Elevation also helps IronMarket evidence how it meets the Consumer Duty.

Rob says the firm chose to focus on ‘member confidence that they’re on track to meet their goals’ as one of their primary KPIs because “focusing on helping our members to achieve their life goals and aspirations is essentially what we do. The greatest benefit which members get from working together with our wealth mentors [how IronMarket refer to their advisers] is peace of mind. Giving members confidence that they’re on track to meet their goals means that they can get on with their lives without worrying – particularly with the economic climate over the last 12/18 months.”

Elevation measures clients’ confidence that they’re on track to meet their goals. By analysing more than 250k clients’ feedback through Elevation, VouchedFor has shown that clients who ‘couldn’t be more confident’ that they’re on track to meet their goals are 41% more likely to recommend their adviser than the industry average, making it a critical KPI for firms wanting to grow organically.

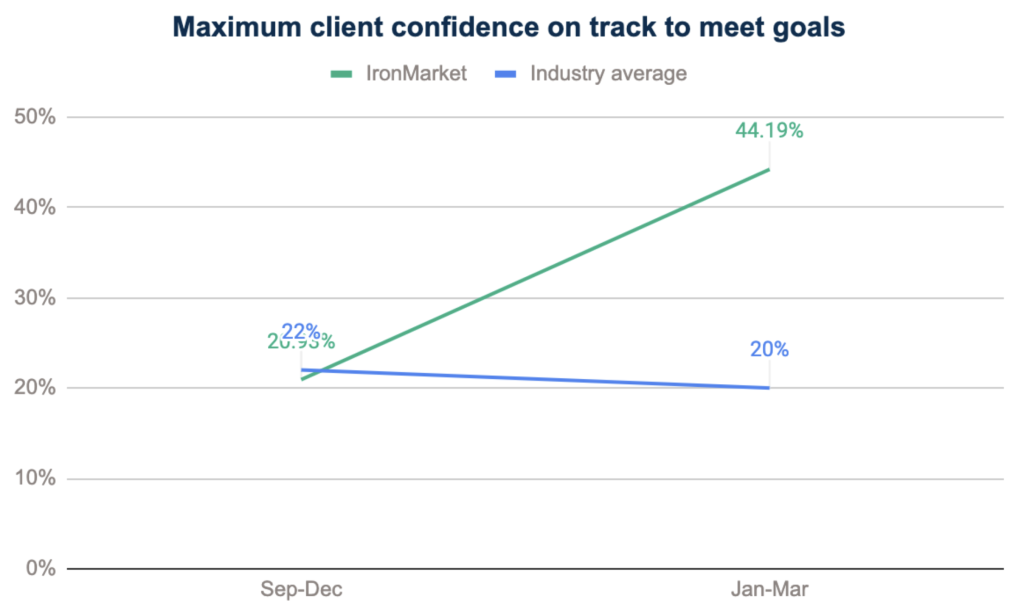

Elevation’s industry-wide data shows that the proportion of clients who ‘couldn’t be more confident’ remained static since the start of this year (shifting from 22% to 20% between 1st January and 18th March). During the same period, IronMarket grew the proportion of their members who reported the maximum level of confidence by 23%, from 20.93% to 44.19%.

Rob says they achieved this by building a culture founded on excellent member experience and structuring the firm’s governance and accountability processes to deliver on this goal. “The first step was to make sure that we asked all our members for feedback. Anything less would not be an accurate representation.

However, Rob is clear that just collecting feedback is not enough. “One of our beliefs is that ‘not everything that counts, can be counted’; it is about more than just a 5* outcome, it is about looking beyond that to what our members are truly telling us” The firm has embedded a process to analyse and act on the insights that they receive.

“I review our Elevation data every day to monitor progress. This enables me to recognise successes, sharing them with the wider team and, as important, identify in which areas we can further enhance our member experience.”

IronMarket has made it their ‘wealth mentors’’ responsibility to review member feedback as it’s received. In the case of any flags, mentors contact members immediately to understand what areas weren’t clear and to ensure that our member has full understanding moving forward, supporting Consumer Duty.

Rob can see how each mentor in his firm is performing, and the mentors have access to their own dashboard showing their strengths and development areas, which aids self-improvement.

“I discuss Elevation feedback in weekly 1:1s with the mentors, and ‘member confidence’ is a KPI discussed in their quarterly reviews.”

Alex Whitson, MD at VouchedFor, commented “IronMarket’s results speak for themselves. There’s been a lot of uncertainty in the market in Q1, as inflation hit 10.1% in January and 10.4% in February. By focusing on the metrics that matter, and taking considered, proactive steps to improve them, IronMarket has outperformed industry benchmarks. But best of all, the team there has given clients all-important peace of mind.”

Elevation, from VouchedFor, is an enhanced client survey, driving business growth.

Powered by 250,000 clients’ feedback, it identifies which factors make the biggest positive difference to client experience, and uses carefully engineered questions within a client survey to reveal how advice firms are tracking against them.

Elevation helps you drive advocacy from existing clients, improve conversion of prospective clients, and mitigate risk by identifying issues early. It can also form part of your ongoing response to the Consumer Duty.

To find out how Elevation can help you, or if you’re interested in getting content to help you meet your Consumer Duty, contact elevation@vouchedfor.co.uk

To learn more about IronMarket Wealth, please visit https://www.net-worthntwrk.com or contact Rob directly – rh@ironmarketwealth.com