The mortgage industry has faced its fair share of change in recent times. From interest rate rises to product scarcity, and now abundance, to the vast range of new technology solutions to consider; many advisers have struggled to give Consumer Duty much headspace.

Rather than just being seen as an increased regulatory burden, for those willing to engage, Consumer Duty presents a significant commercial opportunity. We’ve put together 4 practical steps to help mortgage advisers thrive under Consumer Duty.

4 practical steps for financial success

- Building Trust

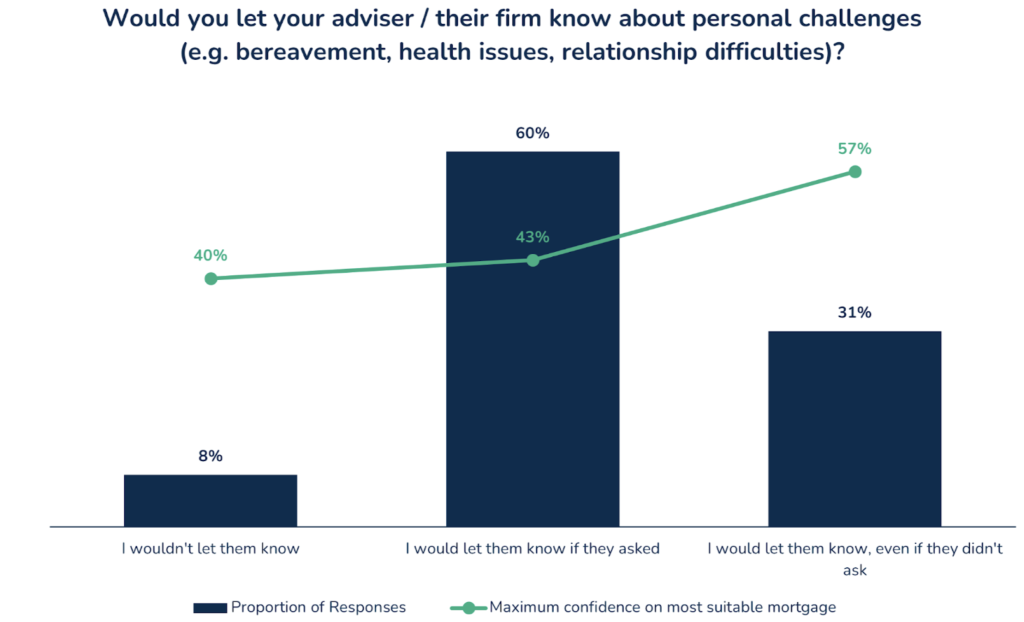

Consumer Duty requires advisers to really know their client, which means understanding their broader hopes and fears. To do this clients need to feel comfortable talking to their adviser about more than just the purchase price.

Clients who feel comfortable sharing personal challenges with their adviser are on average 32.5% more confident that they have the right mortgage for their needs.

- Plan for the future

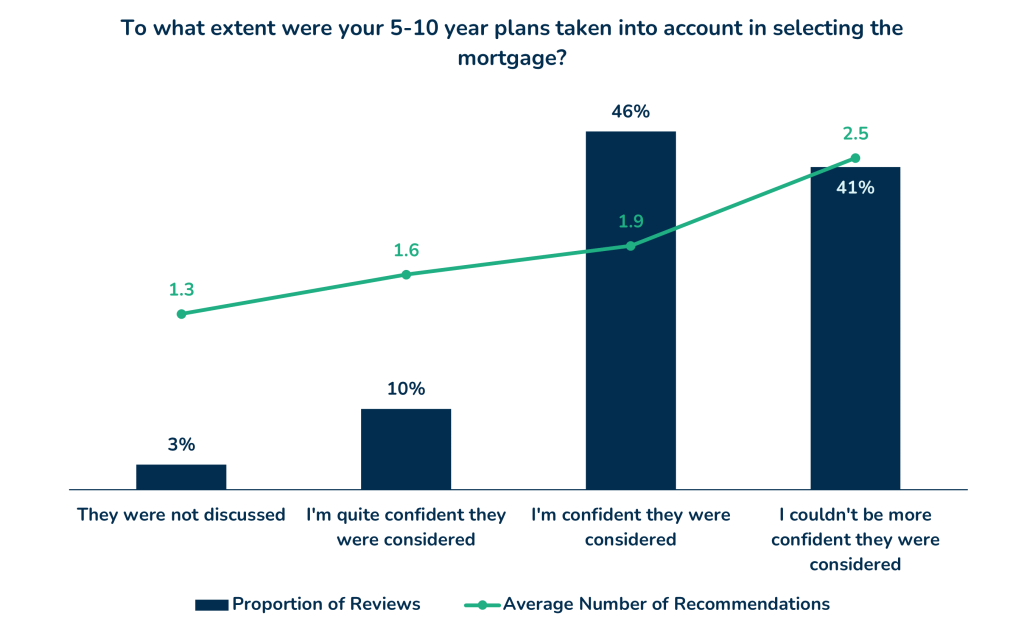

Mortgages can often be seen as transactional; however, they’re always part of a bigger picture. The Products and Services outcome requires firms to ensure the products they recommend meet the needs of their clients. Yet Elevation data shows that over 50% of clients felt their 5-10 year plans were not taken into account by the adviser when selecting a mortgage.

Taking time to understand your clients’ longer term plans, and how the mortgage fits into them, creates a deeper connection and better advice. It also reduces the chance of future complaints and increases passionate advocacy.

- Competitive differentiation

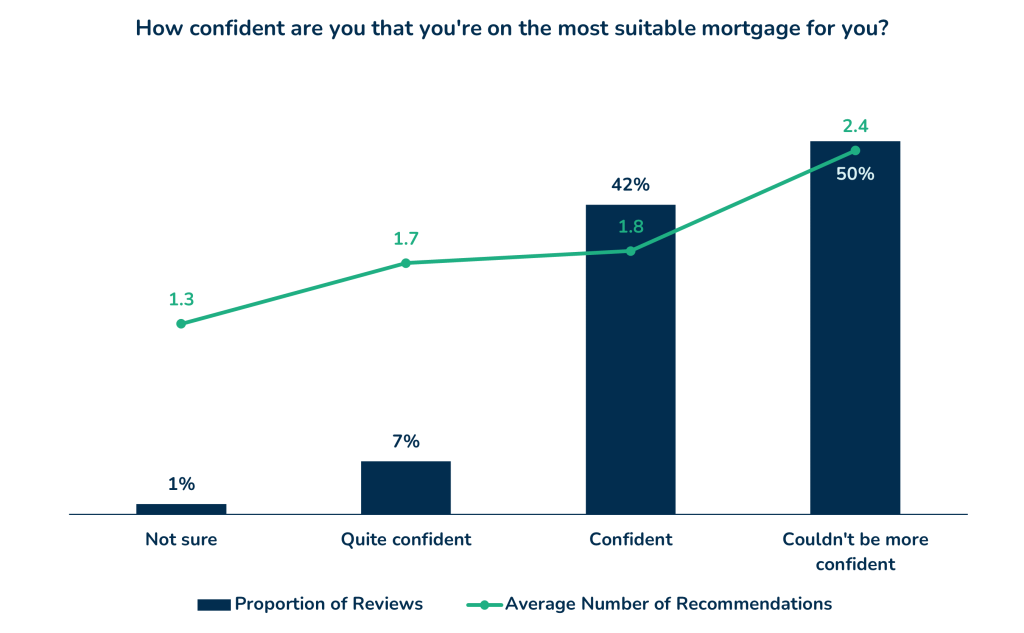

All firms must ensure their service provides value for money, but this isn’t just about price. Value-added services such as free seminars for first-time buyers, guides on becoming a landlord or exclusive access to industry reports and insights can set an adviser apart from the competition. Education also gives clients confidence about the types of mortgages available and a better understanding of the recommended product.

In a crowded market, education is a key differentiator. Elevation data shows that clients who couldn’t be more confident they’re on the most suitable mortgage for them recommend their adviser 33% more than those who are just confident.

Firms who offer their clients added service can command premium fees, attract a higher calibre of clients, and position themselves as industry leaders, whilst demonstrating value for money.

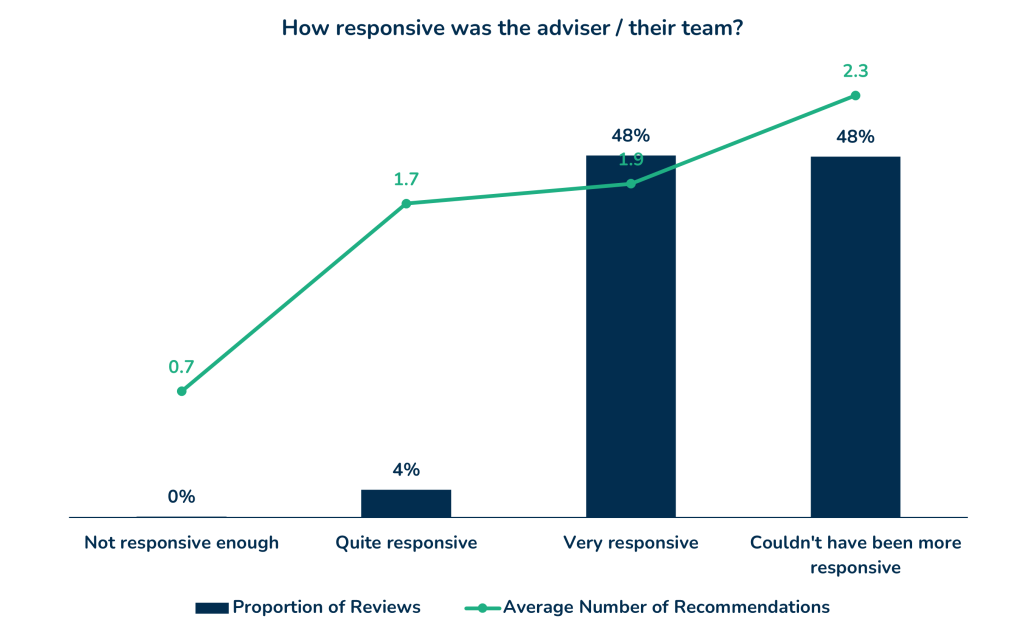

- Enhanced client retention

Customer Support is about being there for your clients, and not just 3 months before their fixed rate expires. Sending out a quarterly newsletter or having a quick catch up call each year means you’ll be the first person they call when their dream home comes on the market or it’s time to build that extension.

When clients do get in touch, it’s important to respond quickly. Around ½ of clients felt their adviser could have been more responsive. This can affect their likelihood of recommending you by more than 20%.

Understanding how your clients feel

Above all, Consumer Duty relies on you understanding how your client feels. The only way to do this is by regularly inviting open and honest feedback. Surveys are a great way to do this by removing any behavioural bias that may creep in when asking clients face-to-face or over the phone. That is providing they ask the right questions, are understandable and engaging.

Our enhanced client survey, Elevation, asks clients about their experience throughout the advice process and covers all of the Consumer Duty outcomes. The questions asked are rigorously tested to ensure they are effective and everything is written in plain english.

A simple indicator of the effectiveness of a client survey is response rates. The average industry response rate to client surveys sits around 15%. The average response rate on Elevation is 45%, providing more feedback for you to work with.

Embrace the future with confidence

The mortgage industry is evolving rapidly. Those who adapt, listen, and innovate will not only survive but thrive. Regulation, like Consumer Duty, provides a pause for firms to consider how they can become better.

By building trust, taking clients long term plans into account, differentiating yourself from the competition and maximising client retention, you’ll be well positioned to take on anything the world of mortgages throws at you.

However, the key to success lies in understanding how your clients feel. Let regular, specific, and insightful feedback be your compass, guiding you to make informed and impactful changes in your business.

Consumer Duty is here. How will you utilise the opportunity it brings?