Imagine transforming a century of failure into unprecedented success with just a series of 1% improvements. This is the power of marginal gains, a concept that revolutionised British cycling.

In the world of competitive sports, the difference between winning and losing often comes down to the slimmest of margins.

For almost a century, British cycling was abysmal. Since 1908 a British cyclist had won just one Olympic gold medal and had NEVER taken a win at the iconic Tour de France. Their training was similar to the other national teams, but they never seemed to get anywhere. Performance was so bad, in fact, that one of the world’s top bike manufacturers refused to sell bikes to the team for fear that it would affect sales if people saw the British team using their gear.

This all changed in 2003, when Dave Brailsford was hired as the team’s new performance director. His theory of “the aggregation of marginal gains” went on to make British Cycling an unstoppable force, and resulted in 20 years of cycling dominance

So, what are marginal gains, and what could the advice industry learn from Brailsford’s approach?

The concept of marginal gains revolves around the idea that making small, incremental improvements in multiple areas can lead to a significant overall enhancement when combined. Instead of focusing on one big change, the philosophy emphasises the power of the cumulative effect of tiny enhancements. Dave Brailsford championed this approach, believing that if every area relating to cycling performance was improved by just 1%, the aggregated improvement would be substantial.

Team GB, under Brailsford’s leadership, applied this philosophy meticulously. Some of the marginal gains they pursued included:

- Redesigning the bike seat to make it more comfortable

- Switching to indoor racing suits, which were marginally lighter and more aerodynamic

- Testing different types of massage gels to see which led to the fastest recovery

- Testing which type of mattress and pillow gave each rider the best night’s sleep and ensuring they only used this combination wherever they went in the world

Brailsford even painted the inside of the team van white to make it easier to see dust which would affect the highly tuned race bikes if it got into the gears.

All these 1% gains had astonishing results. At the 2008 Beijing Olympics, British riders won 60% of the available gold medals. Four years later in London, British riders set 9 Olympic and 7 world records and in the same year Bradley Wiggins became the first Brit to win the Tour de France. The year after, Chris Froome won the race and continued to win giving the British team 5 victories in 6 years.

Applying the principle to financial advice

Financial advisers can make similarly impressive gains.

By measuring, testing and refining every part of the advice process, advisers can turn a good service into a world class one.

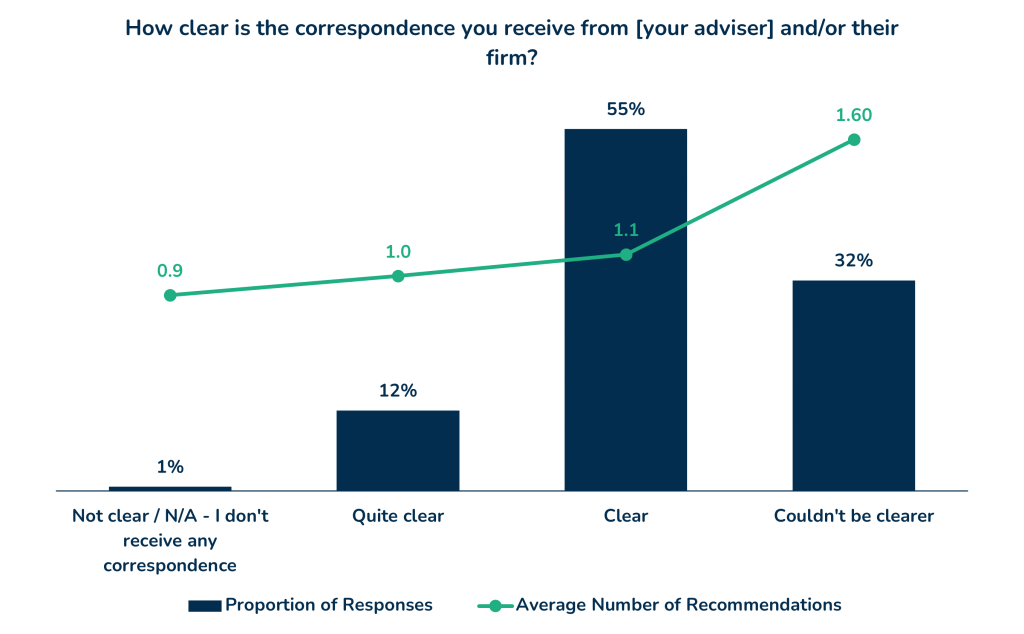

For example, by making sure your correspondence with clients ‘couldn’t be clearer’, it’s possible to increase the number of recommendations per client by 45%.

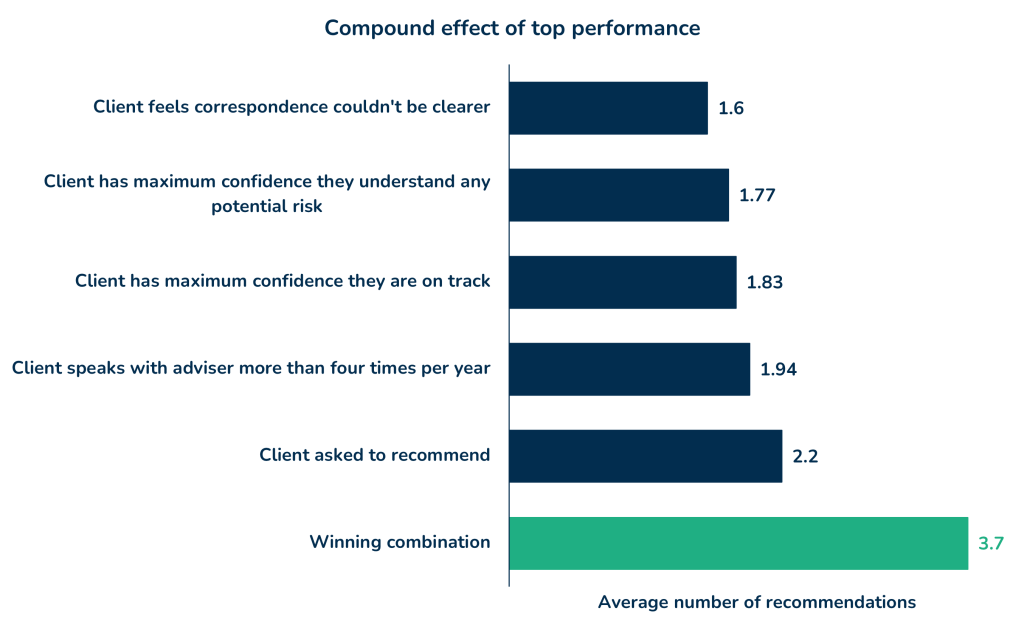

However, by making small improvements across each part of the process, the rewards are substantial. Advisers who get the top response in all six areas which drive client recommendations see a huge 132% increase in the number of times their clients recommend them to others.

The journey to excellence isn’t always about making massive leaps; sometimes, it’s about taking small, well thought out steps forward.

Are you ready to embark on your journey of continuous improvement?