Used correctly, client feedback can become your most powerful tool for driving organic growth. Identify your biggest advocates, fine-tune your practice, and actively request recommendations and you will greatly increase how often clients recommend you to others – much more cost-effective growth than buying leads.

Here are 5 proven methods to start implementing immediately.

1. Share your reviews publicly

Showcase your client reviews somewhere easily accessible – an online review profile, your website, or even your social media page.

If you have a VouchedFor public profile, point clients towards it. 79% of clients are more inclined to recommend their adviser after reading positive reviews about them.

Linking to your profile in your email signature and from your website is a good way to ensure clients see your reviews.

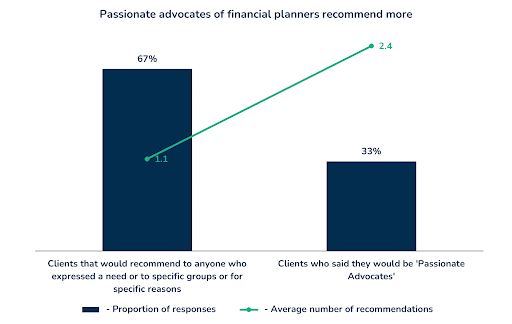

2. Nurture more clients to be ‘passionate advocates’

Most advice clients are happy with the service they receive and say they’d recommend their adviser. But clients who are delighted with their experience recommend their adviser more than 2x as much.

Clients who report feeling “most on track” to reach their goals are 83% more likely to recommend their adviser than those who felt “quite on track”.

Collecting, and acting on, client feedback will help nurture more clients to the point that they would actively recommend you.

3. Check for opportunities in your data

Read all your client feedback. If you’re asking the right questions, you can unearth new opportunities from client reviews.

On average, there are £2,000 revenue opportunities per client review

Elevation email alerts do the hard work for you, making it easy to act on the insights in your data.

4. Ask for recommendations

Asking for recommendations is the most effective way of getting them. Yet 85% of clients don’t believe their adviser has ever asked that they recommend them to others.

Asking for recommendations, on average, leads to 1 additional recommendation per client per year.

Many advisers might not feel comfortable explicitly asking for a recommendation. James Reiss, CEO of David James Wealth, says it’s important to ask in a way that people feel comfortable with. For example, “Many reports show that people are struggling to find advice in the areas that they need it. If you can think of anyone who might benefit from my services, please put me in touch.”

5. Collect regularly

Inviting feedback from all your clients in bulk can be overwhelming, and it can be difficult to track any improvements in the data. Advisers who collect feedback on a regular basis develop a steady stream of manageable opportunities to action.