For advisers who aren’t looking to take on new clients, there are still opportunities to grow revenue from within your existing client bank.

In fact, our data shows that, on average, a single client review for a financial advice client can unlock £2,000 additional revenue (or £200 for a mortgage advice client’s review)

There are just two simple steps to start tapping into additional revenue opportunities in your business.

1. Ask the right questions to uncover valuable insights

Financial advice is complicated, and clients may not take everything in, even if you cover every topic. Luckily, asking for feedback gives clients the opportunity to flag areas they’d like more help with – provided you ask the right questions.

In developing Elevation, our enhanced client survey, we’ve identified two opportunities that can help generate extra revenue for your practice.

Intergenerational planning

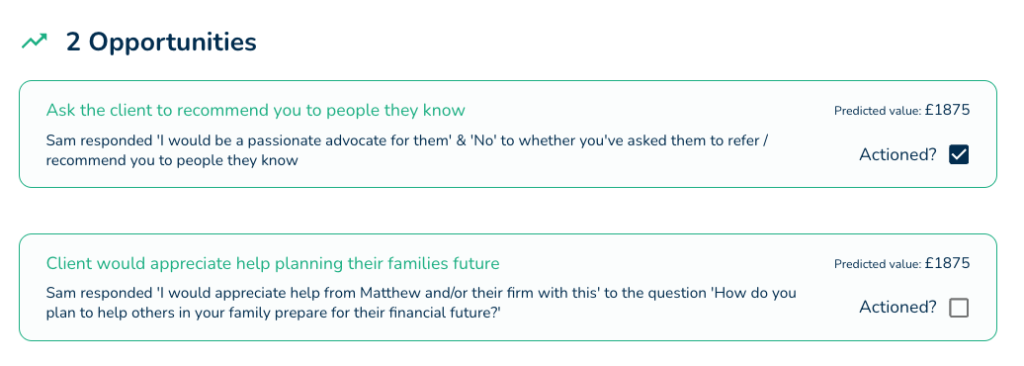

Passing wealth on to loved ones is in the back of most client’s minds, but it’s not always discussed. In 2023, 60% of financial advisers had at least one client say they’d appreciate help (worth £1,875 on average) or they’re not sure (worth £1,125 on average) when asked “How do you plan to help others in your family prepare for their financial future?”

Protection products

Opportunities aren’t just in wealth. In 2023, 36% of mortgage advisers on Elevation had at least one client who said they’d appreciate help when asked “Would you consider taking out an insurance policy to help with your mortgage payments, in case your circumstances change, and you are no longer able to pay?’ (worth £150 on average).

2. Regularly review and act on insights

Scott Atkinson, Managing Director at GPFM, stresses the importance of following up quickly with clients whose feedback highlights an opportunity: “it’s great to have data, but unless you act on it, it doesn’t have much value – you have to be proactive”.

So as well as asking for feedback regularly, make sure you have a process in place to review feedback and identify revenue opportunities.

Elevation, our enhanced client survey, issues a weekly ‘Action List’, highlighting the next most powerful steps you can take to drive revenue and allowing you to track which actions you’ve taken.

Call or email, thanking your client for their feedback, mentioning the area they’ve asked for help with and suggesting a follow up meeting to discuss things further. While it might feel uncomfortable at first, your client will thank you for getting in touch.

Elevation is an enhanced client survey from VouchedFor. It uses client feedback to drive business growth. Powered by 250,000 clients’ feedback, Elevation shows advice firms and advisers the specific actions they can take to meet the Consumer Duty and drive revenue growth.

Elevation offers completely private feedback, industry benchmarks, and a real-time Consumer Duty Report. That’s why more than 1,000 advisers from leading advice firms have chosen Elevation as their preferred survey solution for Consumer Duty.

To find out how Elevation can help you, or if you’re interested in getting content to help you meet your Consumer Duty, contact elevation@vouchedfor.co.uk.