In 1960 the US Navy coined the phrase, “keep it simple, stupid”, for the design principle that underpinned the design of new military aircraft. It has been proven in many applications since: most systems work better if they are simple. Therefore, simplicity should be the goal when designing anything, including financial advice fee structures.

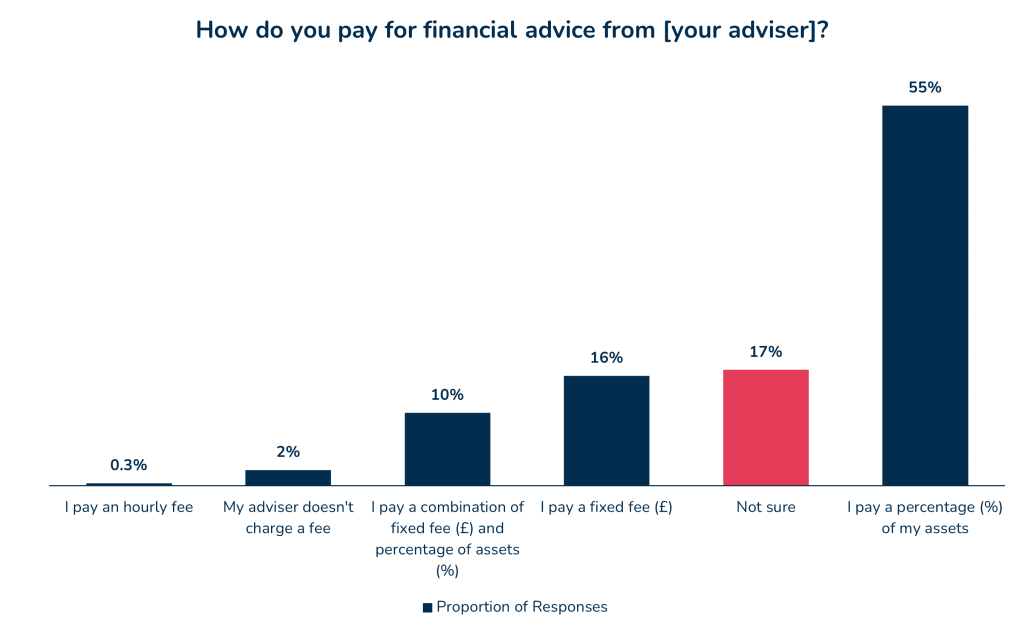

Consumer Duty’s price and value outcome requires advisers to demonstrate that their service provides value to clients. Many advisers’ price structures are needlessly complicated. Elevation data shows that 17% of clients don’t know how they pay their adviser and 2% think their adviser doesn’t charge them at all.

The argument that clients value what they understand has never been more relevant. In this article, we’ll explore the impact of fee structures and suggest some practical tips for advisers to create simple but effective fee structures.

Understanding the Current State of Fee Structures

Consumer Duty stipulates that customers should receive fair value from their products and services. To know if they are, they first need to understand what they’re paying. Elevation data around understanding points to one of two issues:

- Overly complicated fee structures

- Poor explanations of fees by the adviser

It’s a lot easier to explain a simple fee structure, so keeping it simple could kill two birds with one stone.

Fee structures and their effects on clients

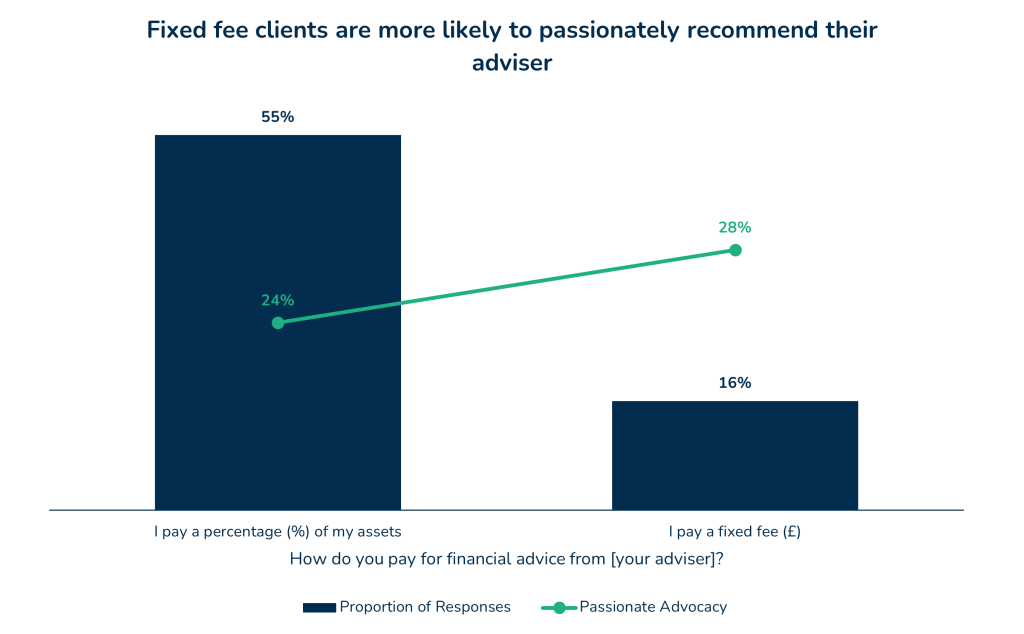

Elevation data shows that over half of clients currently pay a percentage of their assets for financial advice. Only one in six clients say they pay fixed fees.

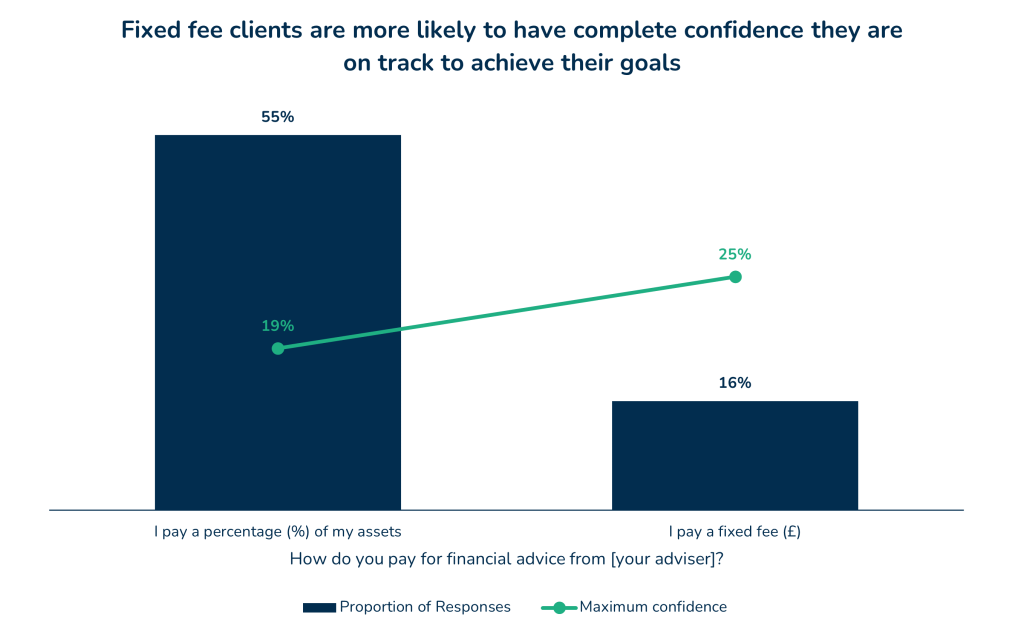

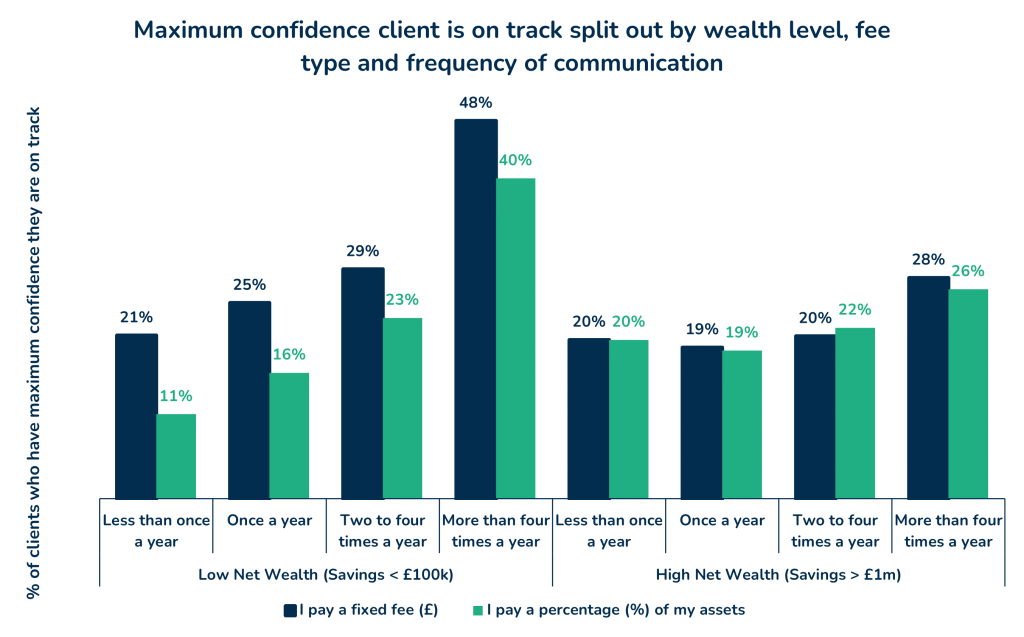

Despite this, clients who pay a fixed fee are 31% more likely to feel on track to meet their financial goals(25% v’s 19%).

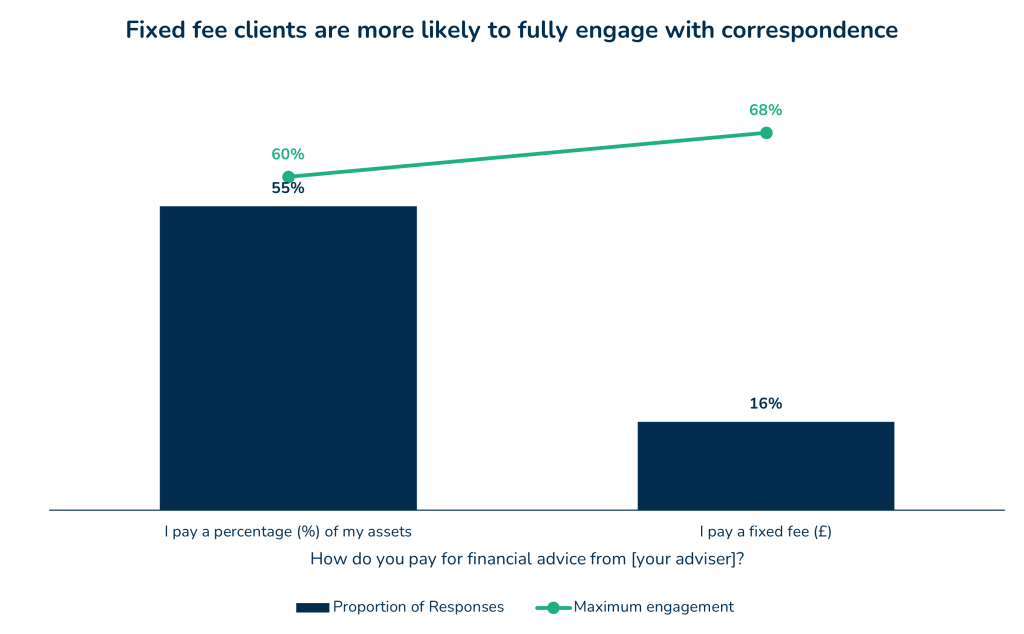

They were also 13% more likely to engage with correspondence from their adviser (68% v’s 60% engagement) and recommended their adviser to others 17% more than those who paid a percentage of assets (28% v’s 24% passionate advocacy).

However, not all clients get the same benefit from the fixed fee model. Clients with less than £100,000 invested generally feel more “on track” when charged a fixed fee rather than a percentage of their assets. On the other hand, clients with more than £1,000,000 in investments didn’t record any difference with how “on track” they felt, regardless of the fee model they were on.

This could be that the fee represents a higher proportion of total assets for clients with less wealth, making them invest more in the process. Conversely, the adviser’s fee represents a lower proportion of total wealth for affluent clients. This makes it less important and removes the incentive to become more engaged in the process, despite the fee being obvious.

The value of simplicity

When it comes to client-adviser relationships, the assurance of knowing what you’re paying is more important than the cost-efficiency of the service. Clients may value an easy to understand fee more than a complex one, even if the simple fee is slightly more.

Why is this the case? For one, it removes the element of surprise. Clients who understand their fees are less likely to be caught off guard by unexpected charges. They’re more likely to trust their adviser, viewing them as an ally and feel more in control of their financial futures.

But it’s not just clients who benefit. A simple fee structure makes it easier for the adviser to explain their services, and how they provide value to the client. It also reduces time taken dealing with misunderstandings.

What can you do?

Here are three actions advisers can take to ensure their fee structures are clear, align with Consumer Duty’s price and value outcome, and effectively convey the value of their service to clients:

1. Conduct a fee structure review

Review your fee structure to see if it is as simple as possible, whilst still providing value to your clients.

- Decrease the number of available options and remove as many variables (caps, collars, gates and add ons) as possible, while still providing value.

- Ensure it’s transparent and understandable. If your fees can’t be explained simply, it may be time for a change.

- Consider the merits of offering fixed fee options. Based on your client bank, fixed fees could give your clients more confidence, increase their engagement and help drive more client recommendations.

2. Ask clients for feedback more often

The best way of finding out if clients understand fees is to ask them. Regularly ask clients about their understanding of the fees they pay and the service they receive in return.

Discuss fees in review meetings to confirm your client understands them. It’s a good sign if they can explain the fees they pay back to you in their own words.

Surveys like the Elevation platform let you get client-specific feedback as well as trends across your client bank. This can be helpful to highlight systemic issues of understanding in areas such as fees.

3. Help clients understand

Disclosure documents can be hard to read and understand so find more engaging ways to explain your fees.

- A simple one-page document explaining in plain English how your fees would work for a specific client could help them understand.

- Most people are visual learners, so visual aids like charts, graphs or infographics can make fee models easier to understand.

- Lastly, as a species, we learn from stories, so case studies can be a valuable tool to aid understanding.

Consumer Duty challenges advisers to create fee structures which produce value for clients. The value of clients understanding the fees they’re paying far outweighs any “on paper” value calculation as it allows clients to easily judge if your service provides value to them.

The simpler the fee structure, the easier it is to understand and therefore the more value it creates for the client. Maybe the US Navy got it right after all. The best plan is to keep it simple, stupid!